EUR/USD:

The single currency ceded further ground to the US dollar Tuesday, consequently registering its third consecutive losing day. Reports through German media stating the US could impose the pending 25% auto tariffs as soon as next week, along with the USD index clocking highs of 97.50, weighed on the euro.

In accordance with the weekly timeframe, additional selling as far south as demand at 1.1119-1.1212 could be in store. This is further confirmed on the daily timeframe after recently overthrowing support at 1.1301 (now acting resistance), and potentially clearing the pathway south to demand at 1.1171-1.1220 (seen glued to the top edge of the aforementioned weekly demand).

Closer analysis reveals the H4 candles recently conquered November’s opening level at 1.1314 and the 1.13 handle. Though this is considered a bearish signal, traders may also want to acknowledge the ‘completed’ three-drive bullish pattern that merges with a channel support (etched from the low 1.1358).

Areas of consideration:

Considering only the H4 timeframe, the research team agrees the H4 channel support/three-drive bullish pattern is an appealing buy. However, traders should exercise caution, as nearby H4 resistance is seen in the form of 1.13 and also November’s opening level at 1.1314. What’s more, let’s remember both weekly and daily structure display intention to explore lower ground (see above).

On account of the above, we feel the pendulum is swinging towards a move lower: a retest of the 1.1314/1.13 area will likely be seen today, followed by a continuation south, targeting the top edge of daily demand plotted at 1.1220ish. Should traders observe a retest of 1.1314/1.13 take form by way of a H4 bearish candlestick pattern, this is likely sufficient enough to consider shorts in this market (entry/stop parameters can be defined according to this configuration).

Today’s data points: US Prelim GDP q/q; Fed Chair Powell Speaks.

GBP/USD:

The British pound remains under pressure as opposition to UK prime Minister May’s Brexit deal is clearly being felt. This – coupled with a somewhat upbeat USD – witnessed the H4 candles reclaim 1.28 and November’s opening level at 1.2767 to the downside in early European hours Tuesday. In consequence to this, the 1.2723 Nov 15 low, shadowed closely by the 1.27 handle are now in view. What’s also interesting from a technical perspective is the near-symmetrical AB=CD bullish formation recently completed at 1.2733 (red arrows).

The longer-term picture, however, remains unchanged. Weekly price is seen engaging with demand at 1.2589-1.2814, though as of yet has failed to produce anything meaningful to the upside. Price action on the daily timeframe, however, suggests the pair might want to explore lower ground within the walls of the said weekly demand area. The candles, as you can see, are hovering north of the 1.2695 Oct 30 low. While a response from this neighbourhood is possible, the Quasimodo support seen at 1.2635 remains a far more appealing level. Aside from 1.2635 fusing with trend line support (taken from the low 1.1904), the approach, should we push for lower levels, will form by way of an ABCD bullish pattern (red arrows) terminating just south at 1.2614.

Areas of consideration:

Medium term (H4) could witness a bounce higher from the Nov 15 low 1.2723 and converging near-symmetrical AB=CD bullish formation at 1.2733. Though whether the buyers have enough strength to reclaim November’s opening level at 1.2767 and the 1.28 handle is difficult to judge. This is simply due to the fact we’re being given little incentive from the current weekly demand at the moment, as well as daily price suggesting lower levels may be on the cards.

Longer term, nonetheless, focus remains drawn towards the daily Quasimodo support at 1.2635 for potential longs. The fact this level is positioned within the current weekly demand, and fuses with an ABCD correction point as well as a trend line support, marks a reasonably strong buy zone for future use.

Today’s data points: UK Bank Stress Test Results; BoE Financial Stability Report; US Prelim GDP q/q; Fed Chair Powell Speaks.

AUD/USD:

For folks who read Tuesday’s briefing you may recall the piece underlined a potential buy zone shaded in yellow on the H4 timeframe between 0.72 and a Quasimodo support level at 0.7182. Why this area appealed to our research team was simply due to its connection with higher-timeframe structure. Besides forming within the confines of daily demand at 0.7164-0.7224, 0.72 also represents the 2017 yearly opening level on the weekly timeframe.

As is evident from the H4 timeframe this morning, price action bounced from the top edge of the noted buy zone amid US trading hours and is currently attempting to breach October’s opening level at 0.7229 (resistance). Although it would have been more ideal to observe price action drive a little deeper within the buy zone before turning higher, well done to any of our readers who managed to jump aboard this move. Stop-loss orders might be best positioned at breakeven now, with the next area of concern eyed around the double-top resistance at 0.7277.

Areas of consideration:

For those who missed the recent buy off 0.72, there may be a second chance to buy this market should H4 price close above 0.7229 and retest it as support (preferably in the shape of a bullish candlestick signal – entry/stop parameters can be defined according to this configuration), targeting 0.7277.

Today’s data points: US Prelim GDP q/q; Fed Chair Powell Speaks.

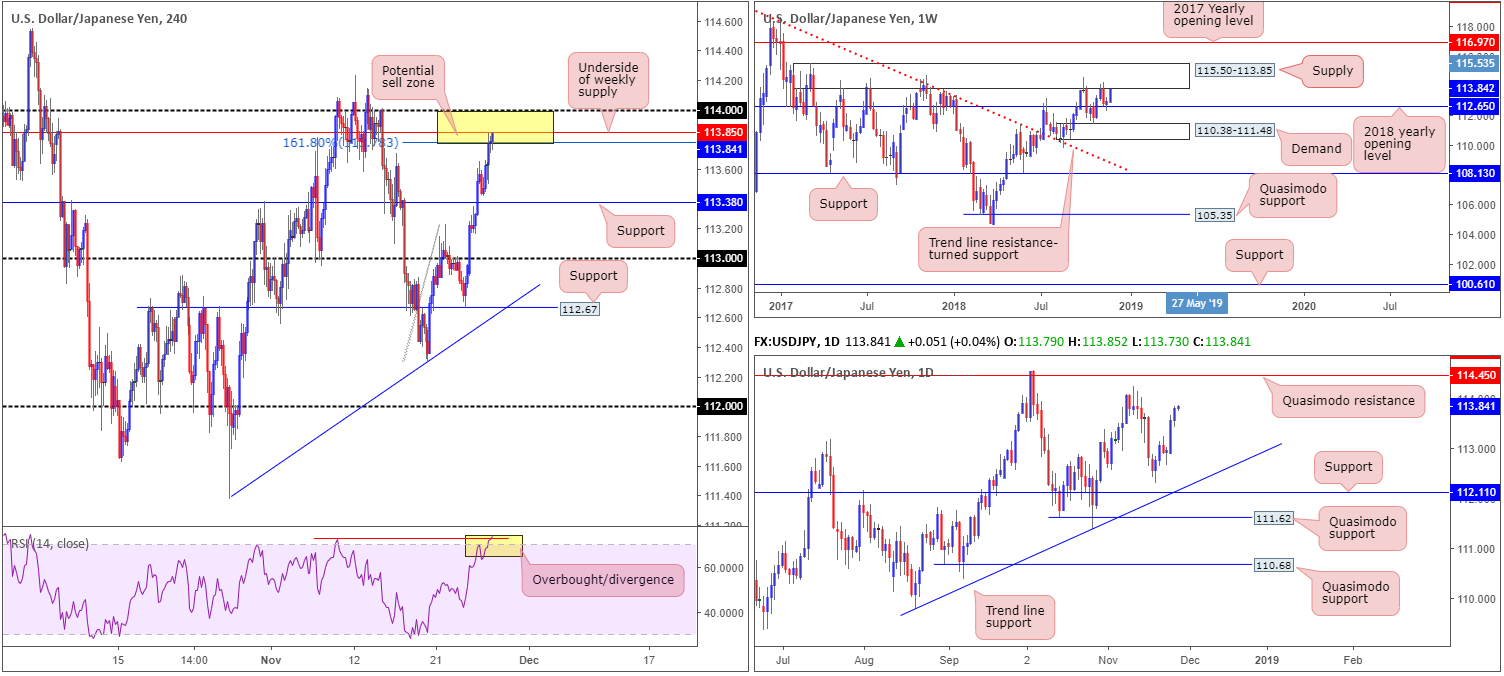

USD/JPY:

Broad-based USD strength reinforced USD/JPY buying Tuesday, consequently recording its third consecutive daily gain and reaching highs of 113.84.

Despite recent upside pressure, the pair could be gearing up for a pullback according to the technical picture. Weekly supply at 115.50-113.85 elbowed its way into the spotlight yesterday, which, as is evident from the timeframe, has notable historical significance, holding price action lower on a number of occasions since May 2017. A closer read on the H4 timeframe highlights (yellow) a 161.8% Fibonacci ext. point at 113.78, the 114 handle and the underside of weekly supply at 113.85. In addition to this, traders might also want to note we have the RSI indicator displaying an overbought/divergence reading.

Areas of consideration:

The yellow H4 zone at 114/113.78 is of interest this morning for possible shorts. A H4 bearish candlestick configuration printed from within this zone, along with its surrounding confluence, highlights a high-probability selling opportunity, targeting H4 support priced in at 113.38 as the initial take-profit zone.

Today’s data points: US Prelim GDP q/q; Fed Chair Powell Speaks.

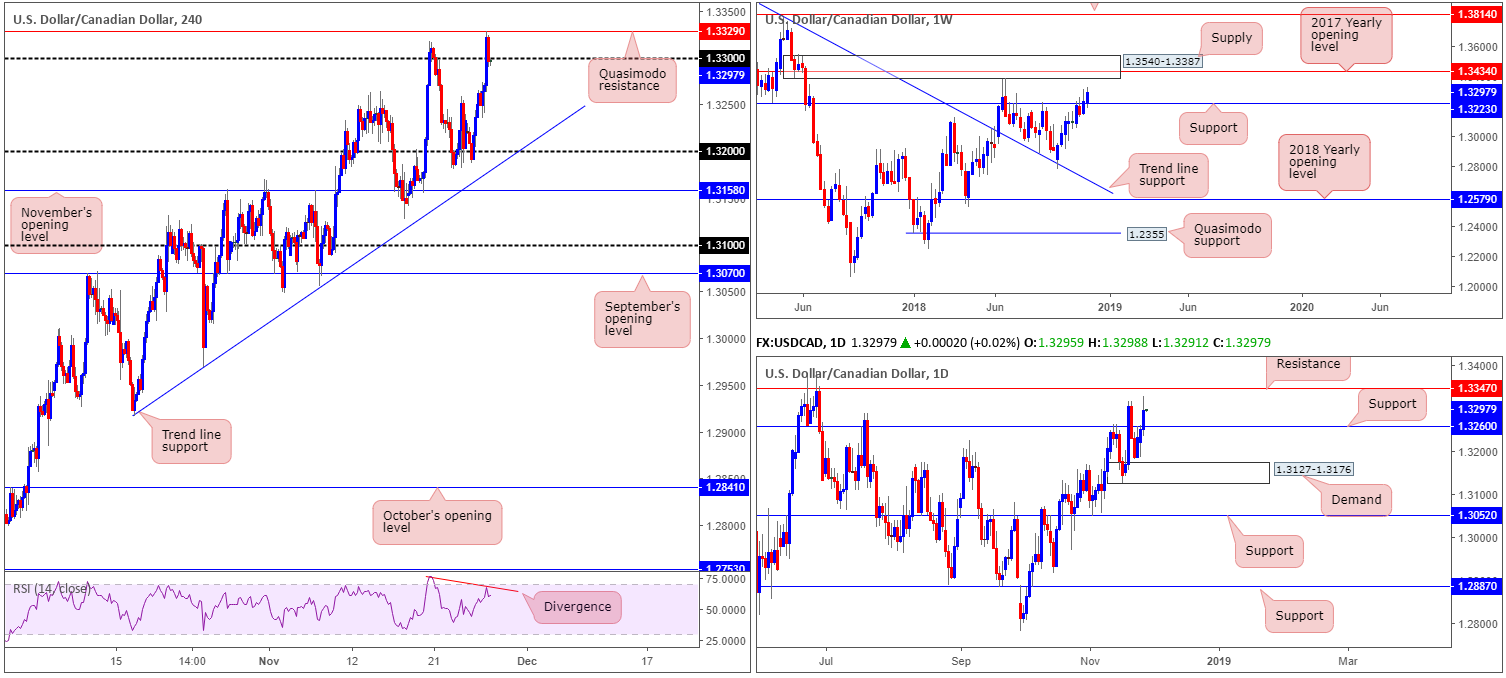

USD/CAD:

In recent sessions, the market observed the USD/CAD gain traction for a third consecutive day, clocking highs of 1.3328. Although H4 action forcefully overthrew its 1.33 handle, price turned lower just south of nearby Quasimodo resistance at 1.3329 and reclaimed 1.33 to the downside into the closing bell. Some traders may also want to note the RSI indicator is seen displaying a divergence reading.

As a result of the recent move above 1.33, a truckload of stop-loss orders from traders looking to fade the number were likely filled, as were buy orders for those attempting to play the breakout. With sellers potentially weak around this region, further buying could be on the menu. This is further confirmed on the higher timeframes. Weekly movement, after working its ways through resistance at 1.3223 (now acting support), displays room to challenge supply at 1.3540-1.3387. In addition to this, daily flow also shows scope for further buying towards resistance at 1.3347.

Areas of consideration:

With both weekly and daily timeframes showing room to explore higher ground to at least 1.3347, and sellers possibly weak around 1.33, the H4 Quasimodo resistance mentioned above at 1.3329 appears to be in a vulnerable position.

On account of the above, this remains a buyers’ market for the time being. A H4 close back above 1.33, followed up with a retest of the psychological band as support (preferably in the shape of a bullish candlestick signal – entry/stop parameters can be defined according to this configuration) could be sufficient enough to trade long and target daily resistance at 1.3347 as the initial take-profit zone.

Today’s data points: US Prelim GDP q/q; Fed Chair Powell Speaks.

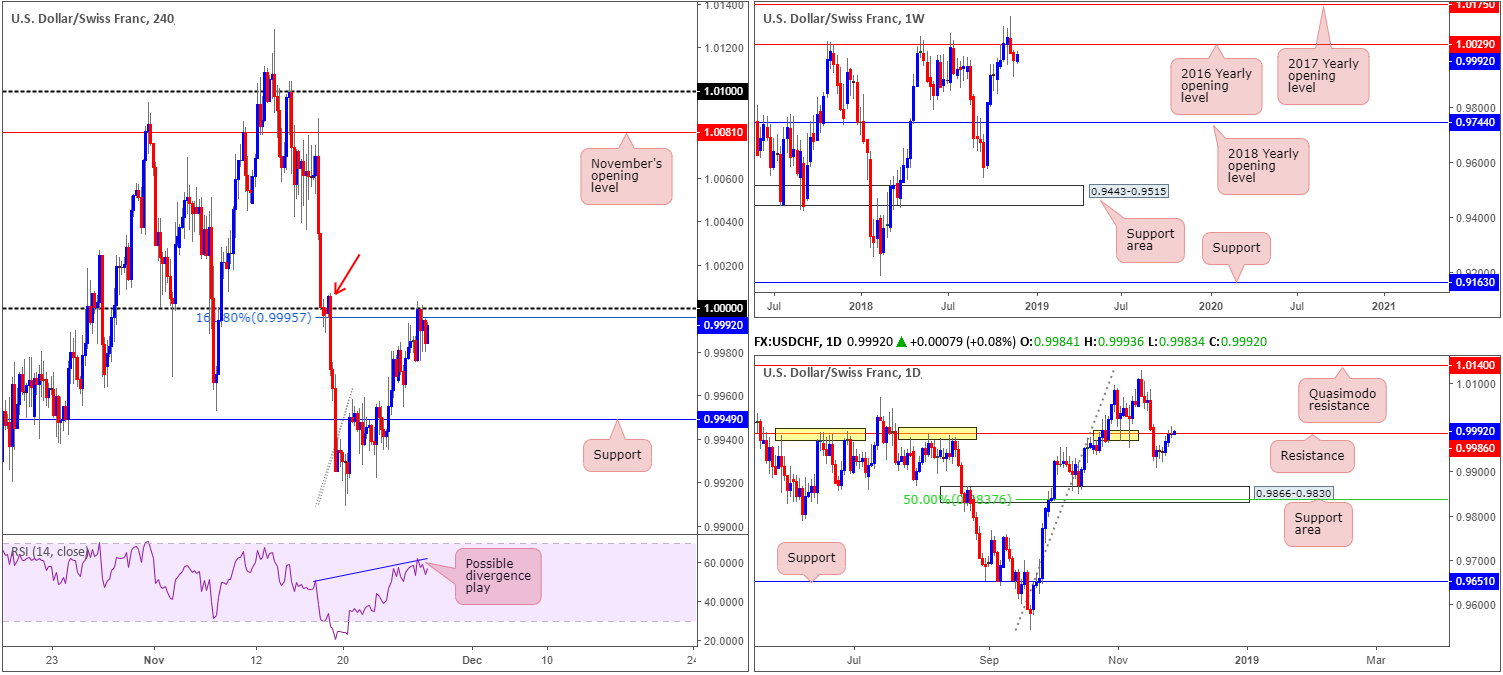

USD/CHF:

For the first time since mid-November, the USD/CHF confronted parity (1.0000) on the back of broad-based USD strength. Supported by a 161.8% Fibonacci ext. point at 0.9995, H4 supply marked with a red arrow at 1.0007-0.9988 and the RSI indicator running a possible divergence play, the buyers failed to sustain gains above 1.0000 on Tuesday.

By and of itself, 1.0000 is a critical number and garners an incredible amount of attention. Couple this with the surrounding H4 confluence, as well as daily resistance seen below it at 0.9986, we could be in for a substantial move lower from here. The only caveat to this forecast falls on weekly structure. Price action shows room to possibly rally above 1.0000 and retest the underside of the 2016 yearly opening level at 1.0029.

Areas of consideration:

Should a bearish candlestick signal appear from 1.0000 (a bearish pin-bar or bearish engulfing pattern would be ideal), we feel this would be enough to justify a short position in this market, targeting H4 support at 0.9949 as the initial port of call.

Today’s data points: US Prelim GDP q/q; Fed Chair Powell Speaks.

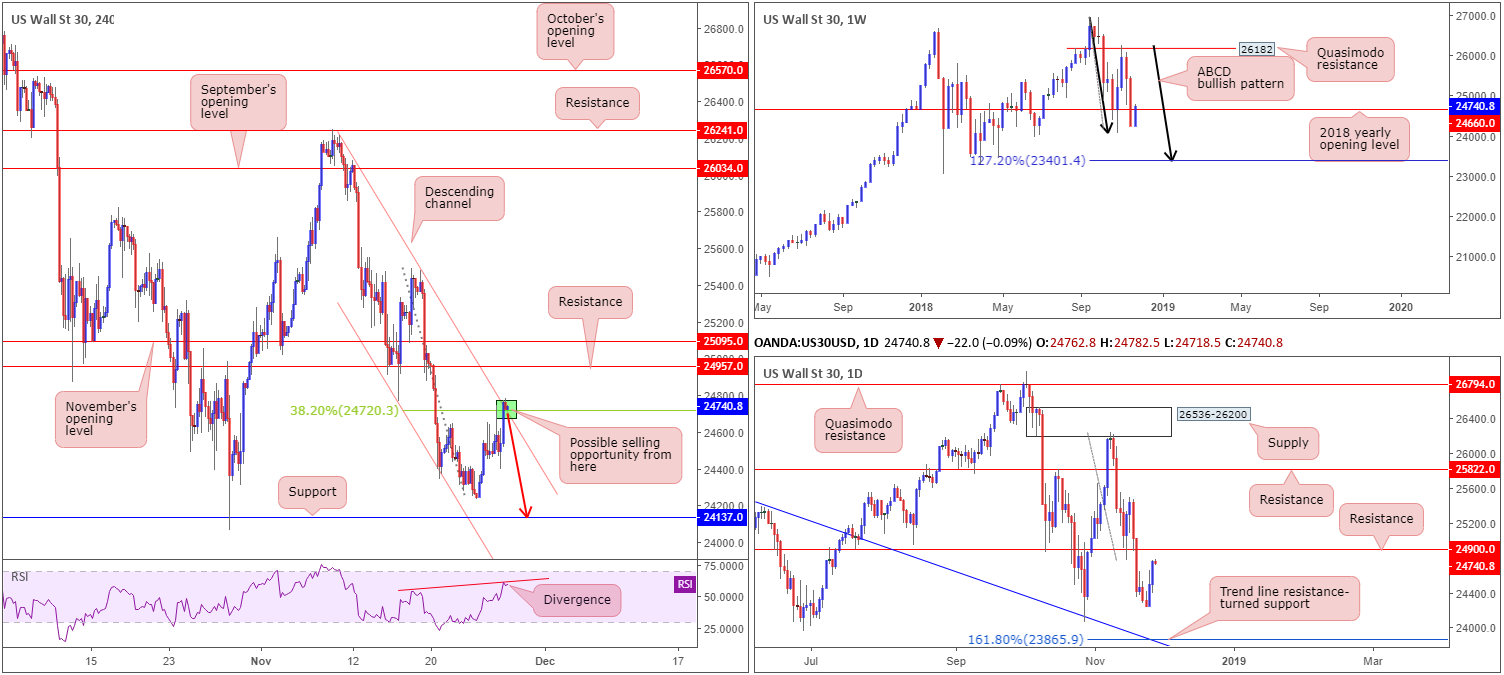

Dow Jones Industrial Average:

US equities concluded Tuesday’s segment in positive territory. Registering its second consecutive gain, the H4 candles shook hands with channel resistance (etched from the high 26217), which happens to merge closely with a 38.2% Fibonacci resistance value at 24720 and a divergence play out of the RSI indicator. In addition to this, weekly price is seen testing its 2018 yearly opening level at 24660 (resistance).

As tempting as it may be to sell the noted H4 structure, traders may also want to take into account the possibility of daily price continuing north to bring in resistance at 24900.

Areas of consideration:

Given the possibility of a move through the said H4 channel resistance, traders are urged to consider entering on the back of additional candlestick confirmation. Not only will this provide entry/stop parameters, it’ll also help avoid an unnecessary loss as traders will have to wait until seller intent emerges. As for take-profit targets, H4 support at 24137 appears a reasonably logical starting point.

Today’s data points: US Prelim GDP q/q; Fed Chair Powell Speaks.

XAU/USD (Gold):

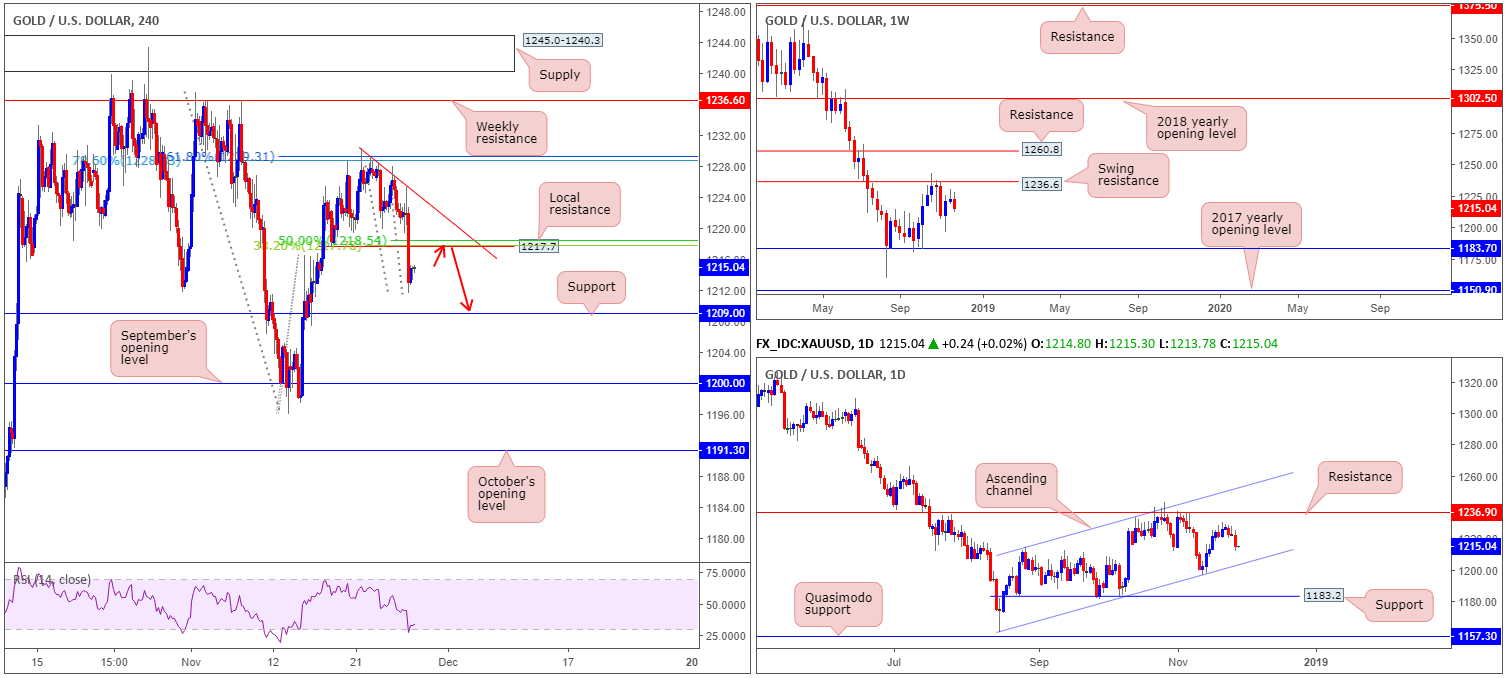

Across the board, the greenback advanced against its major trading peers Tuesday, therefore weighing on the precious yellow metal. Local H4 support at 1217.7 (now acting resistance), as you can see, was abruptly taken out amid early US hours, testing lows of 1211.6.

A retest to the underside of the recently broken H4 support as resistance today could draw in sellers towards H4 support at 1209.0. Although this would be considered an intraday trade, there is actually scope for further selling beyond 1209.0 towards the daily channel support (extended from the low 1160.3). What the research team also likes about 1217.7 as a potential resistance is the converging 38.2% H4 Fib resistance at 1217.8 and a 50.0% H4 resistance value at 1218.5.

Areas of consideration:

In the event the H4 candles retest the underside of 1217.7 (red arrows) today by way of a bearish candlestick pattern (entry/stop parameters can be defined according to this configuration), a sell on the back of this is valid, according to the overall technical picture, targeting 1209.0 as the initial take-profit zone.

The use of the site is agreement that the site is for informational and educational purposes only and does not constitute advice in any form in the furtherance of any trade or trading decisions.

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability with regard to financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site. The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site.

IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.