EURUSD:

Similar price action can be observed in EUR/USD, which came under pressure following the sharp rally to 1.0650 on December 29th.

The pair reached a low of 1.0450 in yesterday's New York session, and the recent price action suggests that selling interest on larger rallies remains high. Immediate resistance is now seen at 1.05, followed by stronger resistance at 1.0590 and 1.0650.

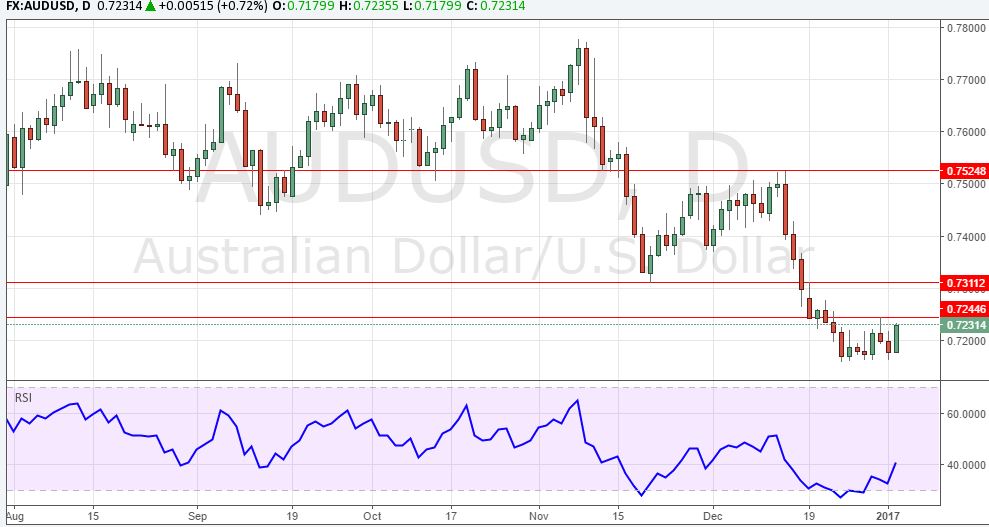

AUDUSD:

AUD/USD caught a bid of momentum and is marching towards 0.7245 resistance. It shouldn't be a difficult level to take out, but the pair faces strong resistance near the 0.7310 level, which previously acted as key support.

However, a clear break above would pave the way for a move to at least 0.7525, and possibly 0.76. While the medium-term outlook remains bearish, short-term techs suggest that further gains could be ahead, especially if the 0.7310 resistance is breached.

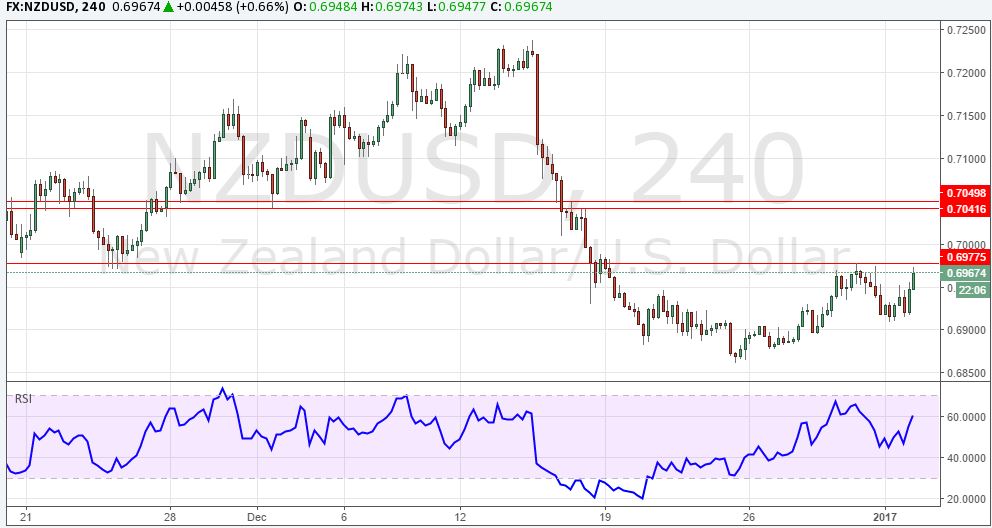

NZDUSD:

NZD/USD is currently struggling with 0.6980 resistance, but a breakout seems imminent. Key resistance is seen at 0.7040/50, and selling interest is likely to be decent there.

Overall, the outlook remains bearish and the aforementioned area might provide a good opportunity to establish a short position.

USDCAD:

USD/CAD had a sharp reversal off 1.36 resistance and short-term technical outlook is now muted. Key support is seen at 1.3357 (with the 50% Fib from the December rally also close), and it needs to hold for short-term techs to remain positive.

A break below would suggest that we will see a deeper retracement, to at least 1.32.

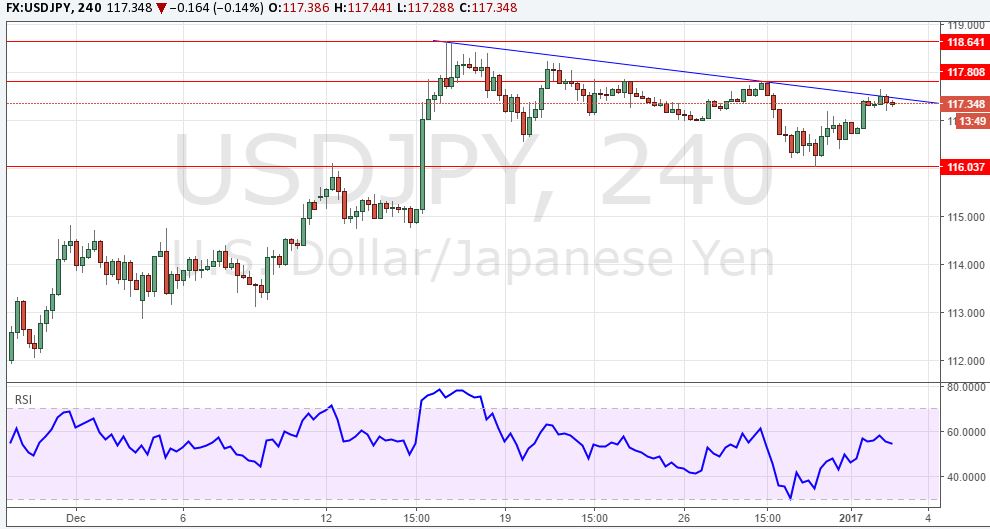

USDJPY:

USD/JPY had a strong bounce off 116 and has rallied back above 117. However, momentum has stalled a tad as it faces decent resistance ahead of the 118 level and the major obstacle remains 118.65 (December high).

While USD/JPY continues to look stretched in the short-term, it would need a clear break below 116 for a deeper retracement to follow. Further, the daily RSI has exited the overbought zone for the first time since mid-November.

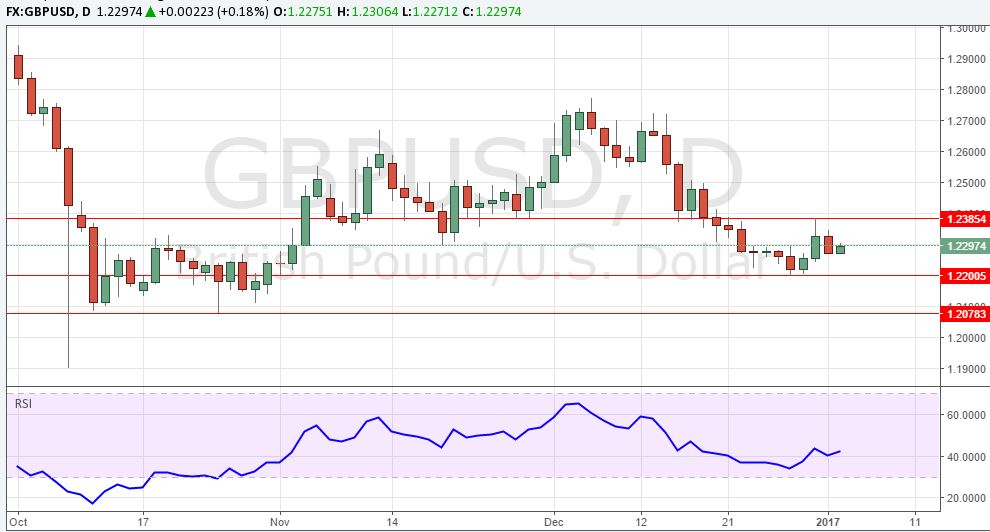

GBPUSD:

GBP/USD continues to consolidate. While it had a strong bounce off 1.22 support last week, it failed at 1.24 resistance and ran out of momentum.

The short-term technical outlook remains mixed, but selling rallies still the preferred strategy, as the overall outlook continues to be negative. A break below 1.22 support would pave the way for a 1.2080 test.

XAUUSD:

Short-term techs in Gold have turned bullish following the convincing break above $1150 resistance, and further gains seem likely.

The next notable resistance level now lies at $1180, although the area between $1200 and $1205 is far more significant, and the precious metal is likely to encounter strong selling interest there. However, for now, buying dips is the preferred strategy, with key support at $1144.