Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails/wicks – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

We typically search for lower-timeframe confirmation between the M15 and H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 1-3 pips beyond confirming structures.

EUR/USD:

Weekly gain/loss: + 48 pips

Weekly closing price: 1.1821

Despite the weekly timeframe stamping in a strong-looking selling wick, price failed to generate anything noteworthy to the downside last week. Instead, what we saw was the pair decisively print a close above weekly resistance at 1.1768, which has directly exposed a weekly resistance level coming in at 1.2044 (not seen on the screen).

The daily timeframe initially highlighted both the demand at 1.1650-1.1733 and supply drawn from 1.1870-1.1786. The supply suffered multiple breaks to the upside the week prior, giving the impression that the bulls were heading higher. However, what we failed to see last week was the supply (formed by an overlapping tail/wick that broke the 7/6/2010 low at 1.1876) lurking just above this area at 1.1968-1.1862.

A brief look at recent dealings on the H4 timeframe saw the EUR/USD swallow the 1.18 handle after US inflation data came in slightly lower than expected. Price found refuge around the 1.1830 mark (August’s opening level), and ended the day chalking up a selling wick.

Suggestions: Selling conditions remain somewhat uninviting at the moment. This is due to the 1.18 handle – coupled with the EUR being entrenched within a strong uptrend at the moment and weekly price currently trading above resistance.

On the flip side, we do have the daily supply mentioned above at 1.1968-1.1862 in view, which has already managed to cap upside two weeks back. Still, the move from this area was, as you can see, quickly stopped by the daily demand at 1.1650-1.1733, which we’re sure you’ll agree, is not the most attractive in terms of its shape and momentum, thus further supporting a weaker sell side in this market.

Overall, our team remains biased to the upside, but at the same time still slightly weary of the daily supply at 1.1968-1.1862! To that end, we would like to see the bulls charge into this zone this week and make their presence felt, before we consider buying this market. A decisive H4 close above the 1.19 mark would be ideal here.

Data points to consider: No high-impacting events scheduled on the docket today.

Levels to watch/live orders:

- Buys: Watching for a decisive close above 1.19 before we consider buying.

- Sells: Flat (stop loss: N/A).

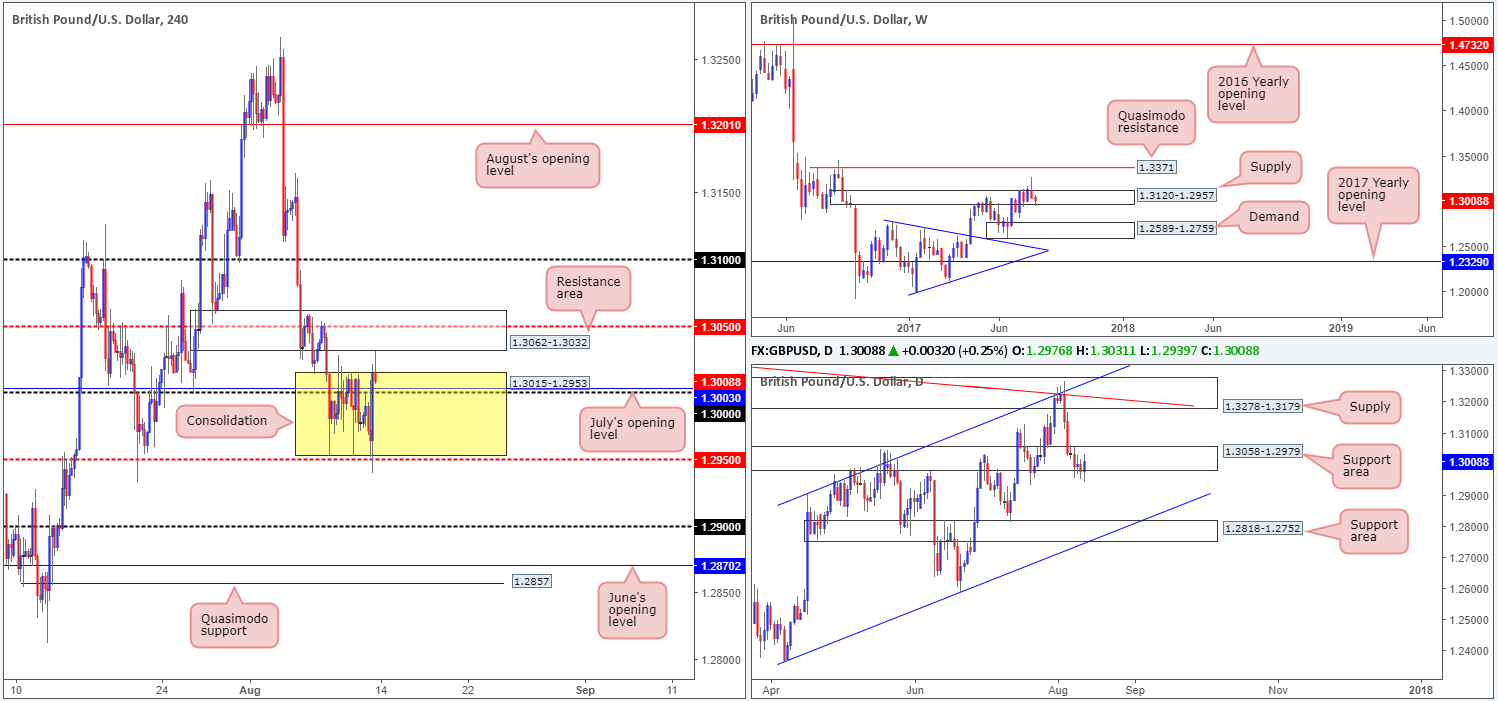

GBP/USD:

Weekly gain/loss: – 25 pips

Weekly closing price: 1.3008

Following a dominant weekly selling wick that closed back within the walls of a weekly supply at 1.3120-1.2957, weekly sellers struggled to register anything noteworthy to the downside last week. In the event that the bears do regain consciousness here, nevertheless, this would likely place weekly demand at 1.2589-1.2759 back in view.

Down on the daily timeframe, the support area at 1.3058-1.2979 has, although it looked incredibly vulnerable all week, managed to bolster price going into the week’s end. A move below this zone would likely expose another support area located at 1.2818-1.2752, which happens to fuse with a channel support etched from the low 1.2365 and is also seen glued to the top edge of the said weekly demand.

Looking across to the H4 timeframe, we can see that the pair spent the majority of the week consolidating between 1.3015-1.2953 (yellow zone). As you can probably see, within the top edge of this range we have the large psychological number 1.30 as well as July’s opening level at 1.3003.

Despite price trading above the 1.30 line, a buy in this market is still challenging. Not only because of where weekly price is currently positioned, but also because of the nearby H4 resistance area seen at 1.3062-1.3032 that houses the mid-level resistance line at 1.3050. A sell on the other hand, would not be of interest to our team until a H4 close is seen below the current H4 range.

Suggestions: A close below the 1.2950 neighborhood, together with a successful retest would, in our humble view, be enough evidence to suggest a move down to the 1.29 handle, followed closely by June’s opening line at 1.2870/H4 Quasimodo support at 1.2857.

Data points to consider: No high-impacting events scheduled on the docket today.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Watch for H4 price to close below the 1.2950 region and then look to trade any retest seen thereafter ([waiting for a reasonably sized bearish candle to form following the retest – in the shape of either a full, or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s wick).

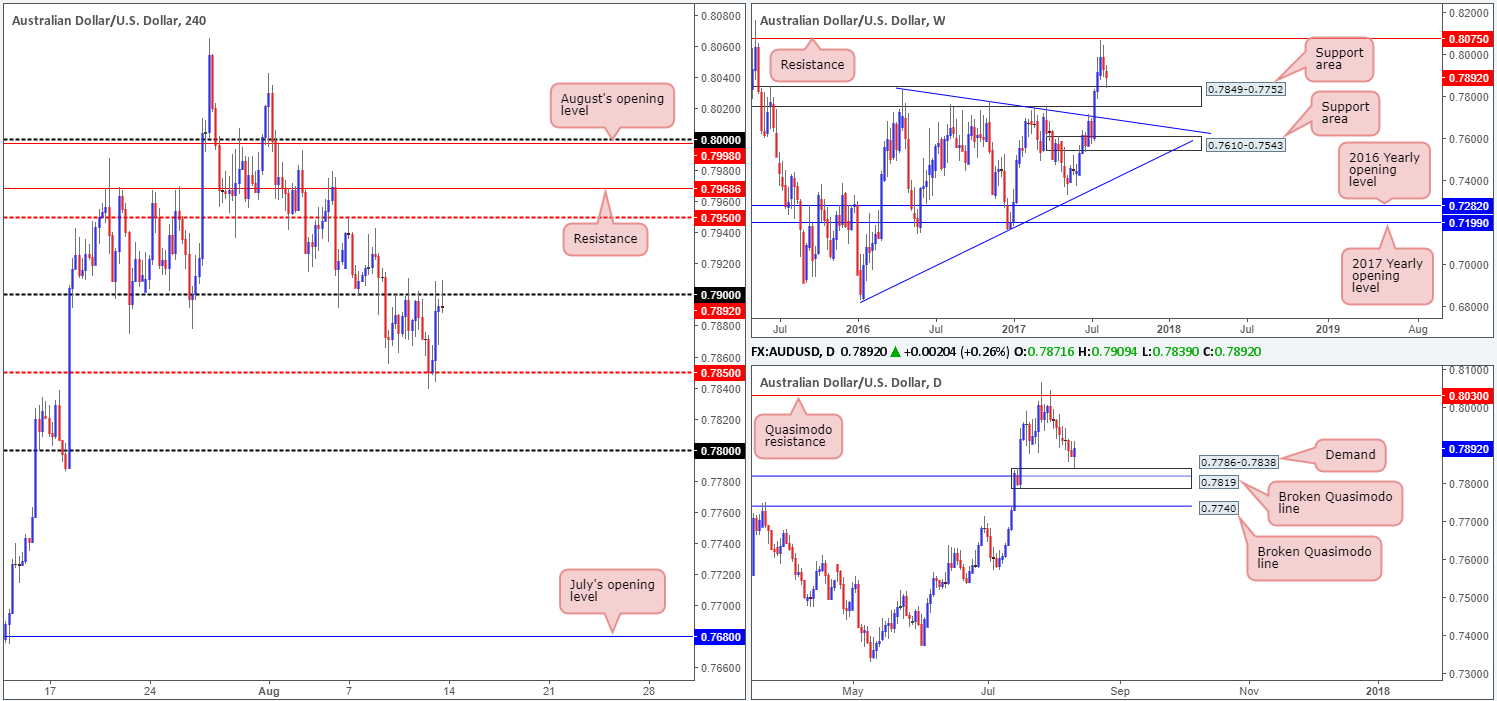

AUD/USD:

Weekly gain/loss: – 37 pips

Weekly closing price: 0.7835

After the near-touch of a weekly resistance seen at 0.8075 two weeks back, the unit continued to slide lower last week and challenged the top edge of a weekly support area chiseled in at 0.7849-0.7752. The response seen from this area, coupled with daily price bouncing from just ahead of a demand base at 0.7786-0.7838 (encases a daily broken Quasimodo level at 0.7819), is likely going to be of interest to a lot of buyers this week!

Punching the buy button at current price, however, may not be the best path to take The 0.79 handle seen drawn on the H4 timeframe has been on the defensive since Wednesday, which was also a recognized support from the 20th July right through to the 8th August. A close above 0.79 would, in our humble view, accomplish two things. Firstly, it would likely confirm higher prices up to at least the mid-level resistance at 0.7950, followed closely by resistance at 0.7968. Secondly, it will help further validate the strength behind the higher-timeframe supports mentioned above.

Suggestions: Essentially, a H4 close above 0.79 is required before our team can take any action. Following this, we will need to see a retest that (preferably) is accompanied by a lower-timeframe buy signal. For entries using lower-timeframe structure we primarily have three setups we look for, which are all detailed at the top of this report.

Data points to consider: RBA assist Gov. Kent speaks at 12.35am. Chinese industrial production at 3am GMT+1.

Levels to watch/live orders:

- Buys: Watch for H4 price to close above 0.79 and then look to trade any retest seen thereafter ([waiting for a lower-timeframe signal to form following the retest is advised] stop loss: dependent on where one confirms this level).

- Sells: Flat (stop loss: N/A).

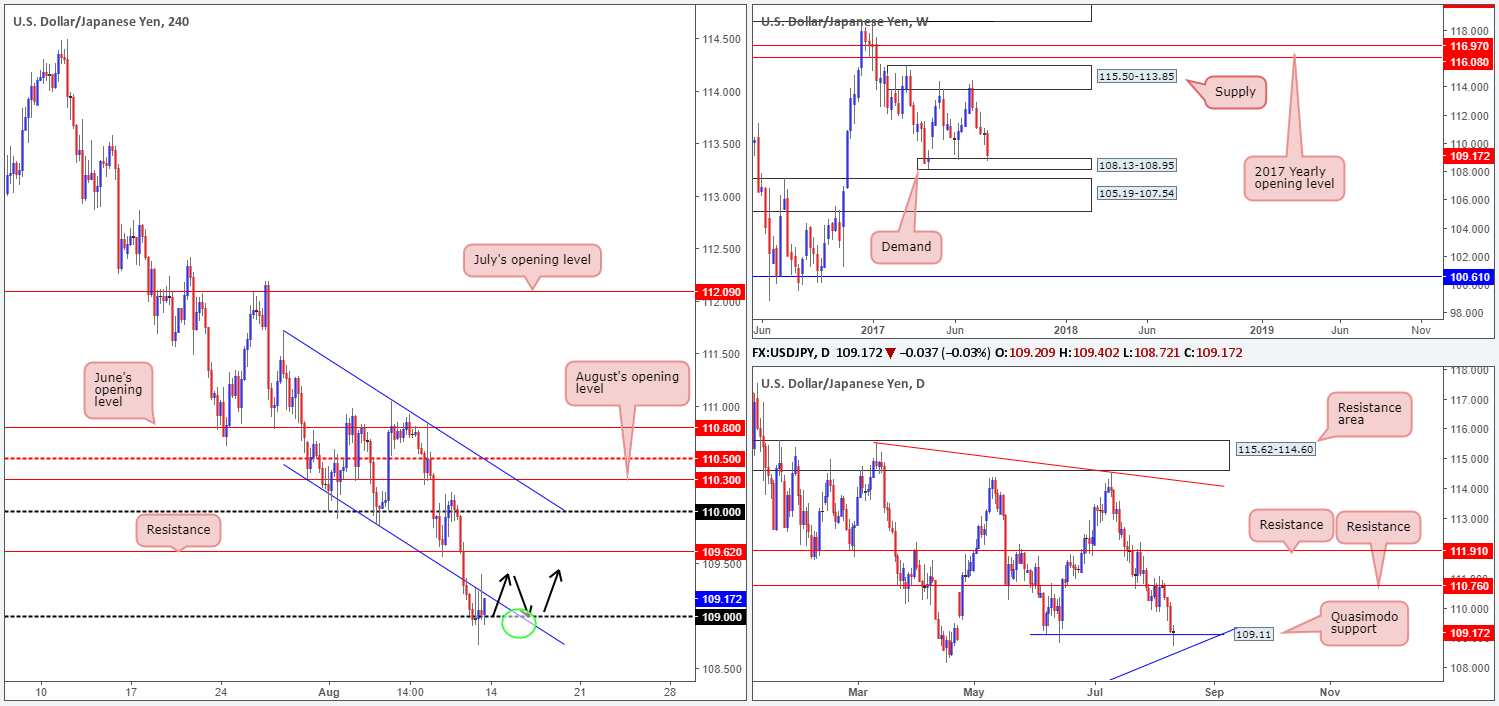

USD/JPY:

Weekly gain/loss: – 151 pips

Weekly closing price: 109.17

The safe-haven Japanese yen remained well-bid last week as tensions between the US and North Korea escalated, consequently bringing weekly action into contact with demand based at 108.13-108.95. This area did a superb job in holding the market higher back in June, so we may see history repeat itself here this week. Should the zone suffer a break, nonetheless, there’s a large support area waiting just below at 105.19-107.54.

In addition to the weekly demand in play right now, we also can see that the daily Quasimodo support at 109.11 remained intact, despite a rather aggressive whipsaw to a low of 108.72. Assuming that this level continues to hold ground, we do not see much in the way of resistance on this scale until the 110.76 neighborhood.

Friday was a quiet day in the market, with H4 price seen clinging to the 109 handle. Collectively, as we mentioned in Friday’s report, all three timeframes show structure suggesting a buy in this market. The question still remains however, how does one go about finding an entry? Simply clicking the buy button, in our opinion, just won’t do given the strength of the approach seen into the above said supports.

Suggestions: Personally, for us to commit to a long from 109, we would want to see H4 price break back into the nearby channel edge taken from the low 110.30, and then retest 109 again as support (as per the black arrows). Ultimately, we’d be looking to target 109.62 initially, followed by the 110 handle which converges with a H4 channel resistance taken from the high 111.71.

Data points to consider: Japanese prelim GDP q/q figures at 12.50am GMT+1.

Levels to watch/live orders:

- Buys: 109 region ([watch for H4 price break back into the nearby H4 channel edge taken from the low 110.30 and then retest 109 again as support] waiting for a H4 bullish candle, preferably a full, or near-full-bodied candle, to form following the retest is advised] stop loss: ideally beyond the candle’s tail).

- Sells: Flat (stop loss: N/A).

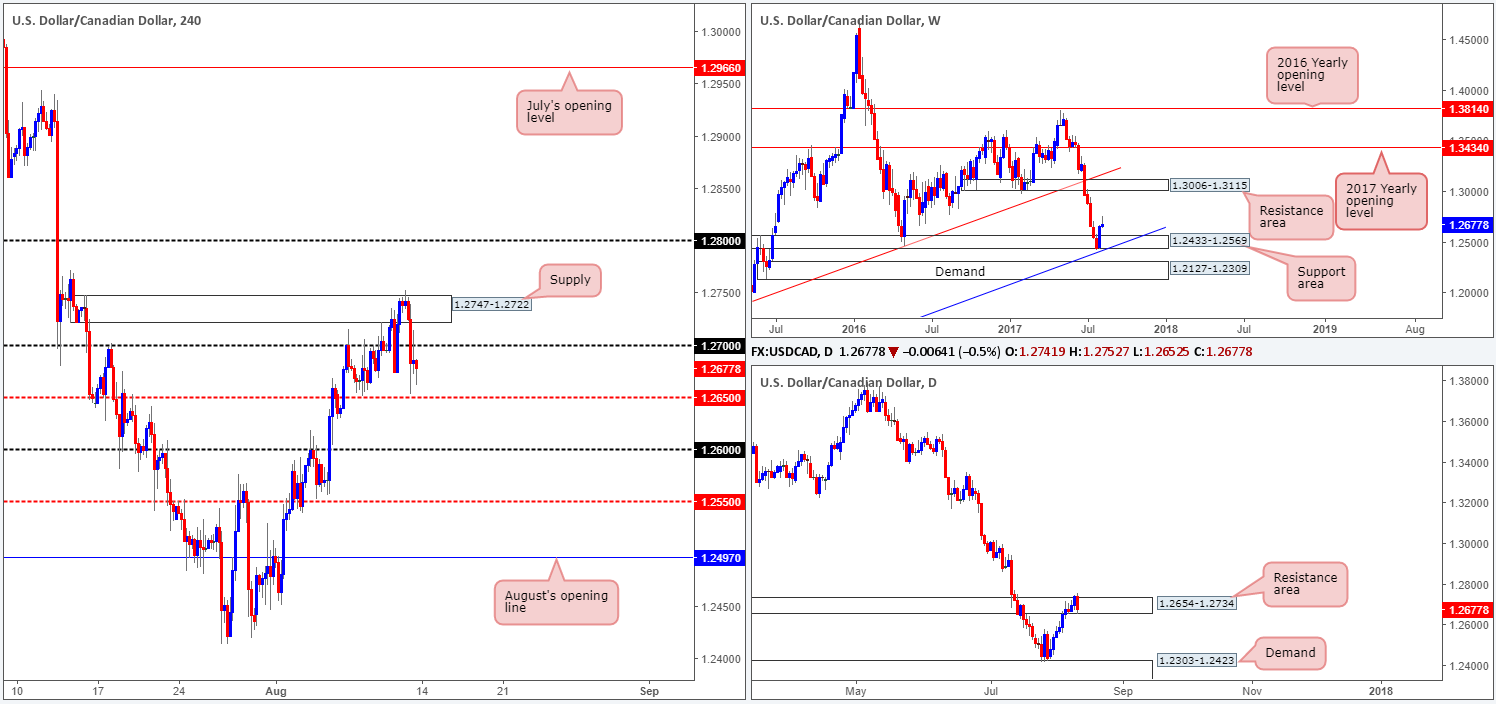

USD/CAD:

Weekly gain/loss: + 28 pips

Weekly closing price: 1.2677

Despite the stronger-than-expected rebound seen from the weekly support area given at 1.2433-1.2569 two weeks ago, weekly sellers came into the fray last week and formed a rather attractive selling wick, also known as a bearish pin bar. Unfortunately, as far as we can see, the candle lacks resistance on this scale.

The daily timeframe on the other hand, printed a bearish engulfing formation around a resistance area fixed at 1.2654-1.2734. This area – coupled with the bearish candle signal, could see the bears reassert their dominance this week. Should this come into view, the next area on the hit list is the demand penciled in at 1.2303-1.2423.

A quick recap of Friday’s segment on the H4 chart shows the supply coming in at 1.2747-1.2722 suffered a minor breach to the upside in early trading. After a small, yet clearly powerful, bearish selling wick took shape, the unit declined in value. The move was further intensified after US inflation numbers failed to meet market expectations, forcing price to break below/ retest the 1.27 hurdle during the later hours of the US session.

For those looking to sell the daily bearish engulfing formation, alongside the weekly bearish pin bar, we would strongly recommend waiting for H4 price to take out the nearby H4 mid-level support etched at 1.2650 beforehand.

Suggestions: A H4 close below 1.2650, followed up with a retest and a reasonably sized H4 bearish candle, preferably in the shape of a full, or near-full-bodied candle, would make for a decent sell. The initial target base would have to be the 1.26 handle. Given how close this number is located, we would not be looking to take profits here, and instead reduce risk to breakeven in the hope that weekly and daily sellers force the market back down into the walls of the weekly support area at 1.2433-1.2569, thus providing us with a healthier risk/reward ratio.

Data points to consider: No high-impacting events scheduled on the docket today.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Watch for H4 price to close below 1.2650 and then look to trade any retest seen thereafter ([waiting for a reasonably sized bearish candle to form following the retest – in the shape of either a full, or near-full-bodied candle – is advised] stop loss: ideally beyond the candle’s wick).

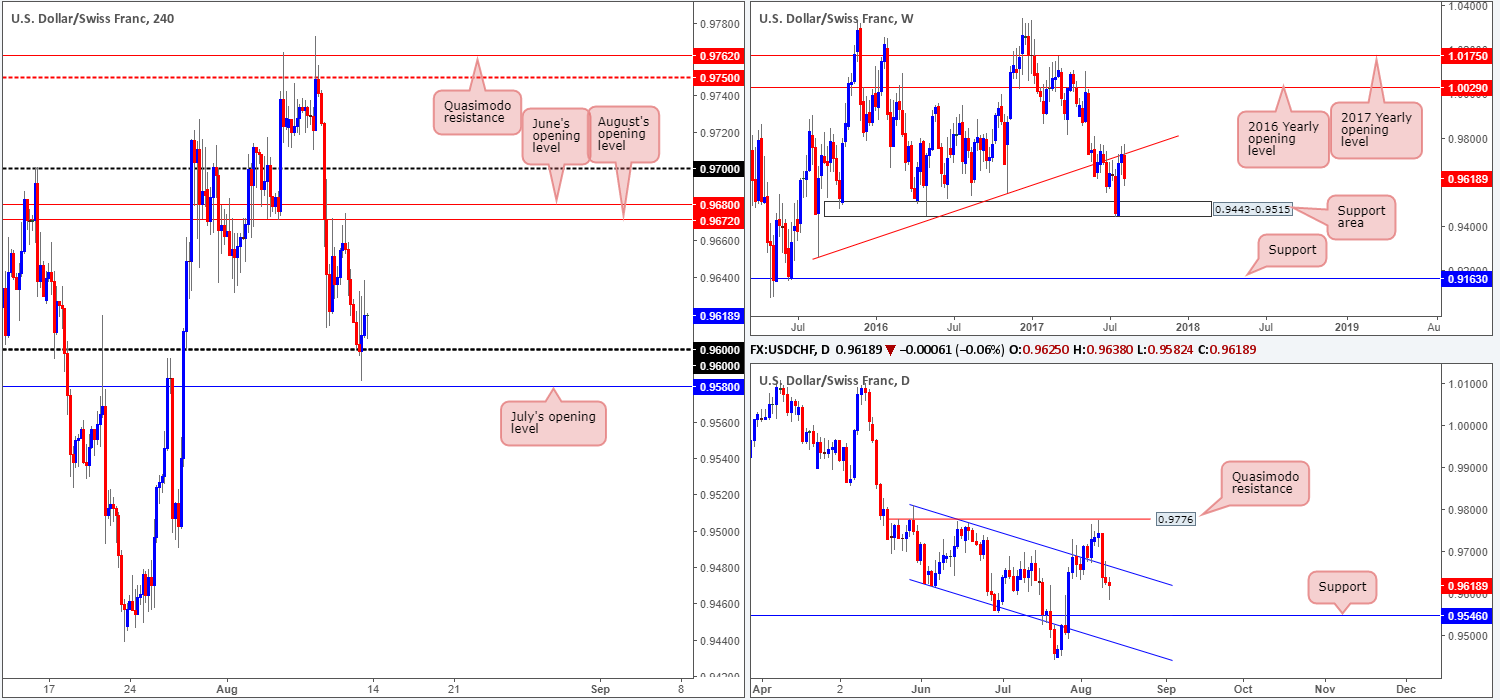

USD/CHF:

Weekly gain/loss: – 109 pips

Weekly closing price: 0.9618

The weekly trendline resistance extended from the low 0.9257 was brought into view over the past few weeks. At the outset, little bearish recognition was seen from this line. That was, of course, until last week where we saw the market selloff heavily from here! The move engulfed the prior week’s candle and has, in our opinion, firmly placed the weekly support area at 0.9443-0.9515 back on the hit list.

In line with weekly flow, the daily candles (after coming within touching distance of a Quasimodo resistance level at 0.9776) dove lower and re-entered the descending channel formation drawn from high to low 0.9808/0.9622. The next support on the hit list from here can be seen at 0.9546 – positioned 31 pips above the top edge of the aforesaid weekly support area.

Over on the H4 timeframe, however, the 0.96 handle remained intact despite an earnest attempt to push lower on the back of lower-than-expected US inflation figures. 0.96 – coupled with July’s opening level at 0.9580 is likely to throw a spanner in the works for anyone looking to sell on the basis of last week’s momentum from the weekly trendline resistance. Usually, in cases such as this we would simply wait for these levels to be consumed and then look to trade the retest. However, given the distance between 0.9580 and 0.9546 (the daily support) is only 34 pips, you’re unfortunately left with little room to maneuver for a short.

Suggestions: On account of the above notes, remaining flat until more conducive price action presents itself is the route we’ve chosen to take.

Data points to consider: No high-impacting events scheduled on the docket today.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).

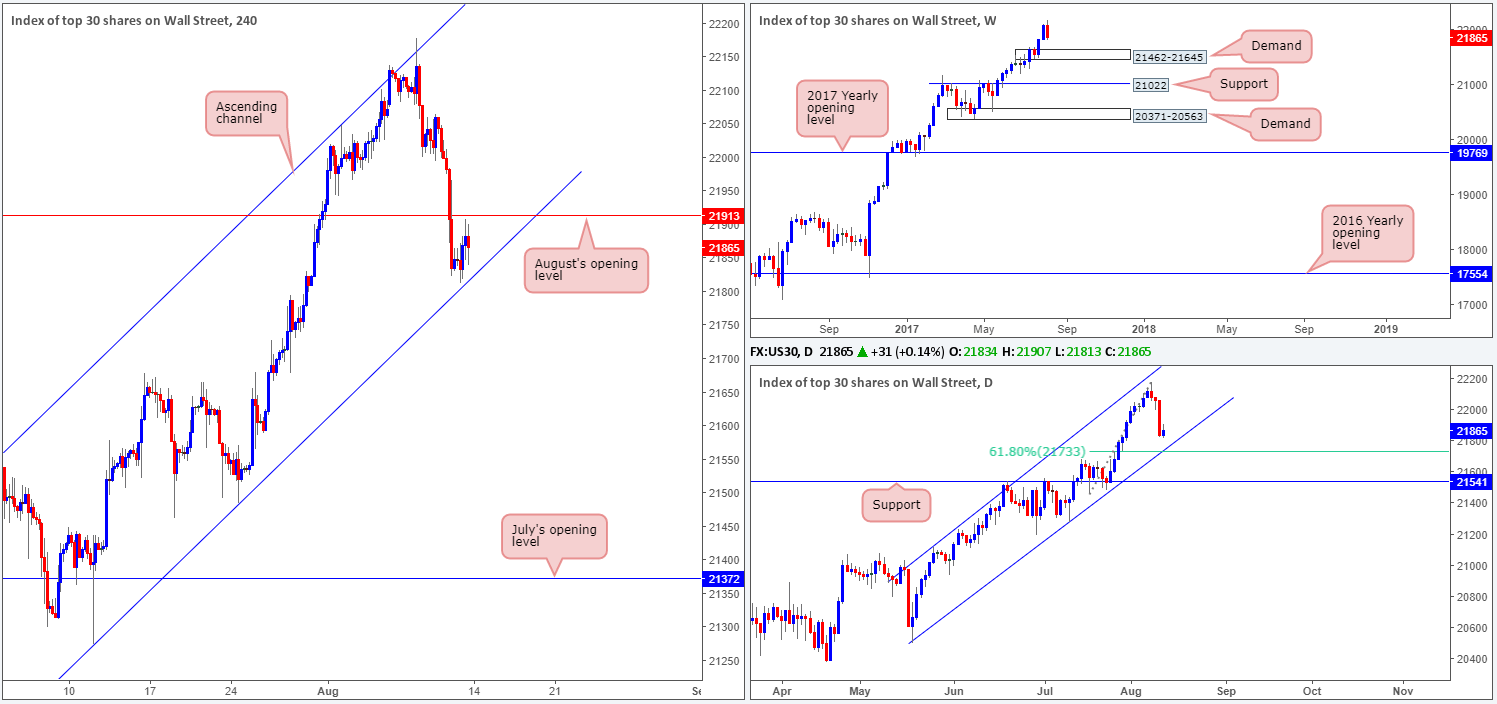

DOW 30:

Weekly gain/loss: – 206 points

Weekly closing price: 21865

US equities declined in value last week, consequently breaking a two-week bullish phase. The move, influenced by escalating tensions between the US and North Korea, wiped out the majority of the prior week’s losses and very nearly formed a weekly bearish engulfing candle! Providing that the bears remain dominant this week, we could see the index revisit weekly demand pegged at 21462-21645.

Looking down to the daily candles, we can see that price is now trading within a stone’s throw away from a channel support line etched from the low 20494 (which fuses with a 61.8% Fib support at 21733 taken from the low 21462) . If you overlap both the weekly and daily charts, you’ll notice that the channel support is in fact located a tad above the demand seen noted on the weekly timeframe. Therefore, a fakeout through the channel support line to the top edge of the weekly zone could be something to keep an eyeball on this week!

A closer look at price action on the H4 timeframe shows the unit closed the week just ahead of a channel support line extended from the low 21273. The trouble here is both the H4 and daily channel supports are positioned relatively close together. Also of particular interest on the H4 scale is August’s opening line coming in at 21913, which is currently lurking above current price.

Our suggestions: In view of the technical landscape at the moment, we initially believed that the H4 channel support will likely suffer a minor fakeout, as traders may press for the daily channel support and its converging 61.8% Fib support for long opportunities. However, seeing as how close the weekly demand is located below the daily channel support, we may be in for an even deeper fakeout than originally anticipated!

When anticipating a fakeout, we tend to always attempt to trade the extreme! And in this case we believe the extreme to be the top edge of the weekly demand at 21645. This may seem a long way off at 220 points from current price, but if the trade comes to fruition and does indeed prove to be a fakeout, the payout could be huge! As for stops and take-profit levels, this will be decided if and when price approaches our buy level. This is where patience comes into play, traders!

Data points to consider: No high-impacting events scheduled on the docket today.

Levels to watch/live orders:

- Buys: 21645 region (stops and take profits to be decided if/when price descends to this number.

- Sells: Flat (stop loss: N/A).

GOLD:

Weekly gain/loss: + $30.3

Weekly closing price: 1288.7

As tensions between North Korea and the US intensified, demand for the safe-haven metal forced price action north last week and recently drove into the jaws of an interesting resistance area seen on the weekly chart. A green zone comprised of two weekly Fibonacci extensions 161.8/127.2% at 1312.2/1284.3 taken from the low 1188.1. Weekly price has, as you can see, responded each time this area has been challenged, therefore there’s a chance that we may see history repeat itself here.

The story on the daily timeframe reveals that price recently crossed above a trendline resistance extended from the high 1337.3. There is resistance seen directly overhead at 1295.4, but apart from the two occasions on 17/04/2017 and 06/06/2017, there’s little history registered with this number! For that reason, we may see price break above this line and head to the resistance carved from 1308.4, which boasts very attractive history dating back to early 2011.

Analyzing Friday’s sessions on the H4 timeframe, supply at 1288.8-1283.4 remained intact despite two aggressive whipsaws through the top edge of the zone. A close above this area would, in our view, confirm a test of the daily resistance level mentioned above at 1295.4.

Our suggestions: Based on the above notes, our desk will not be looking for (long-term) shorts until the daily resistance line plotted at 1308.4 is in play. This is due to the history surrounding this number and its position within the current weekly resistance area (allowing us to place stops tightly above this zone).

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 1308.4 region. This is, given the location of this daily resistance on the weekly timeframe, a fantastic level to be looking for shorts if the number comes into view.