Key risk events today:

Australia Building Approvals m/m; China Caixin Manufacturing PMI; UK Final Manufacturing PMI; US ISM Manufacturing PMI.

EUR/USD:

Weekly gain/loss: +0.61%

Weekly close: 1.1094

Weekly perspective:

Europe’s shared currency wrapped up the week in positive territory against the US dollar, snapping a four-week losing streak south of long-standing channel resistance, drawn from the high 1.1569.

Downside targets on the weekly timeframe rest at the 2016 yearly opening level from 1.0873 followed by channel support, taken from the low 1.1109. Further supporting sellers is the primary trend, down since topping in early 2018, at 1.2555.

In the event of continued buying, and a violation of the aforementioned channel resistance, traders’ crosshairs are likely fixed on the 1.1412 June 24th high, as well as the 2019 yearly opening level at 1.1445.

Daily perspective:

Wednesday witnessed price action bottom within a whisker of support at 1.0990, shaped by way of a hammer candlestick configuration (considered a bullish signal at troughs). Thursday modestly explored higher ground, with Friday vigorously absorbing offers and testing trend line support-turned resistance, taken from the low 1.0879, and the 50-day SMA (blue – 1.1094). The 200-day SMA (orange – 1.1126) is next on tap, followed by Quasimodo resistance at 1.1199.

The combination of the trend line resistance and the two SMAs may hinder upside this week.

H4 perspective:

Friday’s mixed Eurozone data, released in early European hours, was largely overlooked. EUR/USD bulls strengthened their grip on the back of a softer buck.

The spread of the coronavirus continues to dominate market sentiment. Downgrades to the Fed’s assessment of private consumption and inflation target also contributed to the US dollar index (DXY) selling.

Traders who read Thursday’s technical briefing may recall the following (italics):

Technical research, based on H4 movement, has price action advancing out of a key reversal zone at 1.0992/1.1009 (comprised of the key figure 1.10, channel support, pencilled in from the low 1.1085, Quasimodo support at 1.0992 and two 161.8% Fibonacci extensions at 1.1006 and 1.1009 – yellow). Price recently overthrew December’s opening level at 1.1023 and scored a high of 1.1039. Limited resistance is visible on this scale until reaching 1.1055.

Well done to any traders long 1.0992/1.1009; this was a noted bullish reversal zone to keep an eye on in previous reports. The H4 close above December’s opening level at 1.1023 was likely a cue for most buyers to reduce risk to breakeven. In addition, it might entice additional buying, particularly if 1.1023 is retested as support.

1.0992/1.1009 proved a strong support zone, and the retest at December’s opening level drawn from 1.1023 provided additional opportunity to enter long. As you can see, price swiftly brushed aside resistance at 1.1055 (now a serving support) and is poised to shake hands with the 1.11 handle and channel resistance, drawn from the high 1.1239. Note also the 1.1100 region represents a Quasimodo resistance level (black arrow). Beyond here, it might interest traders to note another Quasimodo resistance plotted at 1.1147.

Areas of consideration:

The 1.11 handle, the H4 channel resistance and the Quasimodo resistance level at 1.1100 (green) represents an appealing location for sellers today/this week. Couple this with the current daily trend line resistance and 50-day SMA, and we have ourselves a robust reversal zone.

Conservative stop-loss placement can be found above the 1.1118 January 21st high with entry around 1.1100; other traders may prefer waiting for additional candlestick confirmation to form before pulling the trigger. This helps identify seller intent and provides entry and risk levels to work with.

GBP/USD:

Weekly gain/loss: +0.94%

Weekly close: 1.3200

Weekly perspective:

Since late December, longer-term movement on the weekly timeframe has been consolidating between long-standing trend line resistance, pencilled in from the high 1.5930, and demand around the 1.2939 region (black arrow), likely seduced by the recent break of the notable high at 1.3380 (red arrow).

The recent break of the said trend line has the 2018 yearly opening level at 1.3503 to target.

Daily perspective:

Daily activity, in the shape of an outside bullish candle Thursday, shot back above its 50-day SMA (blue – 1.3061). Follow through buying emerged Friday, in position to approach the 1.3284 December 31st high and resistance at 1.3358, which capped upside since July 2018.

Recent buying should not come as a surprise, given recent history. Late December and throughout January, price engulfed the said SMA to the downside in similar fashion, but was able to recover and close higher.

H4 perspective:

The British pound was an outperformer vs. the US dollar Friday, responding to the Bank of England’s (BoE) decision to keep interest rates on hold. GBP/USD made quick work of the 1.31 handle, overpowering offers in this region. Quasimodo resistance at 1.3153 (now a serving support) also failed to put up much of a fight, closing around the 1.32 neighbourhood and drawing the relative strength index (RSI) into overbought terrain.

Areas of consideration:

Shorts off 1.32 are an option, though chancy knowing we’ve jumped through weekly trend line resistance.

Continued buying and a H4 close north of 1.32 exposes January’s opening level at 1.3250. A retest at 1.32 prior to striking 1.3250 unlocks potential intraday bullish themes. Drilling down to the lower timeframes here and attempting to trade on the back of local structure could be something to consider as this may increase risk/reward to 1.3250.

A correction to H4 support at 1.3153 is also a possible scenario, likely attracting traders seeking a buy-the-dip scenario. Drilling down to the lower timeframes here is also worthy of consideration.

AUD/USD:

Weekly gain/loss: -1.99%

Weekly close: 0.6686

Weekly perspective:

Since registering a bottom in late September at 0.6670 (2019), price carved out a rising wedge formation, typically considered a continuation pattern.

The past five weeks witnessed price decline back into the rising wedge and, thanks to recent selling, break and extend beyond the lower edge. With the primary downtrend having been in full force since topping at 0.8135, in early 2018, moves lower should have always been a possibility.

Assuming a break of the 0.6670 September 30th low, support at 0.6359 is in the offing (not visible on the screen).

Daily perspective:

Price action on the daily timeframe settled a few points north of support from 0.6677, after respecting Quasimodo support-turned resistance at 0.6769 Wednesday. Note also that the current support level denotes a Quasimodo support base (black arrow).

The next support target beyond 0.6677 falls in around 0.6508 (not visible on the screen).

H4 perspective:

Subdued dollar action and reasonably steady China PMI readings had limited impact on AUD/USD downside Friday. The pair, weighed by concerns surrounding the coronavirus, maintained a strong bearish presence, closing lower for a third successive session and testing near four-month lows at 0.6670 – essentially daily support highlighted above at 0.6677.

Several lower-timeframe supports gave way, as did the 0.67 handle, which as you can see was retested as resistance into the close.

Traders who read previous reports may also recall the following pieces (italics):

H4 price has been chalking up a head and shoulders top pattern since mid-December 2019 (left shoulder sports a top at 0.6938, right shoulder at 0.6933 and the head at 0.7031 – green). The neckline is drawn from the 0.6838 December 18 low and the 0.6850 January 9 low (black line). H&S traders will be looking for 0.6671ish as a take-profit target (calculation from the head to neckline added to the breakout point – black arrows).

There will likely be traders short this market on last Tuesday’s H4 close south of the H&S neckline. In addition, price retested the neckline last Friday and rotated lower, another noted entry point.

Areas of consideration:

Well done to any readers short the H4 H&S formation, either on last Tuesday’s breakout or Friday’s neckline retest.

With 0.67 cleared, price action came within touching distance of 0.6671 Friday, the H&S take-profit zone. This was likely close enough for most traders to consider covering short positions.

Chart studies, however, suggests leaving a portion of the position running, as weekly price proposes we may dethrone the current daily support around 0.6677 and head for lower terrain.

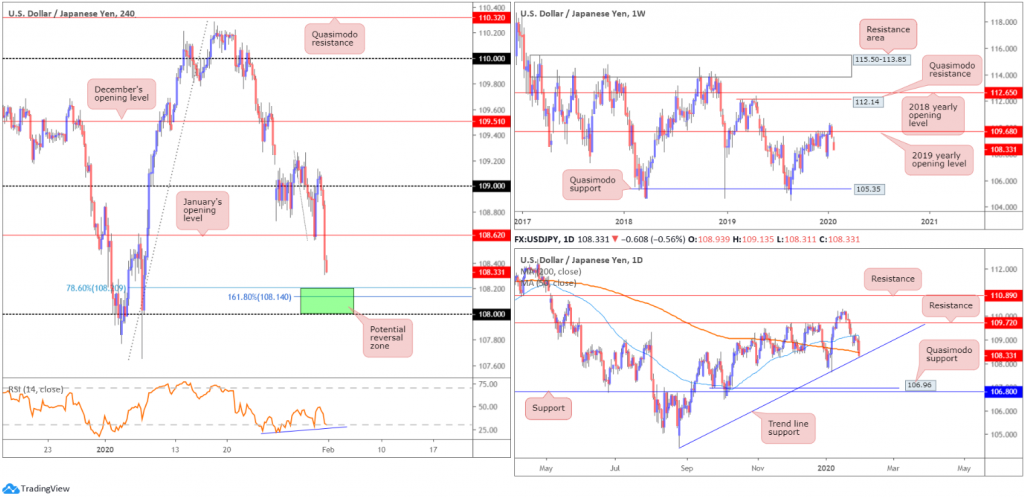

USD/JPY:

Weekly gain/loss: -0.86%

Weekly close: 108.33

Weekly perspective:

After eclipsing the 2019 yearly opening level at 109.68, testing highs at 110.29, and pulling lower, longer-term flow appears set to tackle the 107.65 January 6th low this week. Beneath the aforementioned low, limited support is evident until reaching the Quasimodo formation coming in at 105.35.

Daily perspective:

A closer examination of the daily timeframe reveals the unit trades a few points ahead of trend line support, extended from the low 105.59. Note also the 200-day SMA (orange – 108.45) resides close by.

Aside from the 107.65 January 8th low, support beneath the current trend line can be seen around a Quasimodo formation at 106.96, closely followed by another layer of support at 106.80. To the upside, nevertheless, the 50-day SMA (blue – 109.18) resides close by, accompanied by resistance plotted nearby at 109.72.

H4 perspective:

Coronavirus jitters and global growth concerns returned at the end of the week, souring risk sentiment and increasing demand for safe-haven assets, such as the Japanese yen, Swiss franc and gold. Alongside US equities, USD/JPY fell sharply in the closing hours, overwhelming January’s opening level at 108.62 and testing lows of 108.31, levels not observed since January 8th.

From a technical standpoint, The H4 candles have eyes on a particularly interesting area of support between the 108 handle, the 161.8% Fibonacci extension point at 108.14 and the 78.6% Fibonacci retracement at 108.20 (green). This is further confirmed by the relative strength index (RSI) producing bullish divergence (blue line), along with the daily trend line support underlined above (105.59).

Areas of consideration:

108/108.20 is likely on the radar for many traders today/this week for potential longs.

Traders who feel the confluence supporting 108/108.20 is sufficient may opt to enter long at 108.20 and position protective stop-loss orders beneath 108. While this may offer a favourable setting, the threat of a fakeout through 108 is certainly there (psychological figures are prone to whipsaws).

Conservative traders may choose to wait for H4 price to close higher after entering the zone. This allows an entry on the closing candle, with protective stop-loss orders beneath 108.

In terms of upside targets, January’s opening level at 108.62 is the next logical step, followed by 109 and then the 50-day SMA.

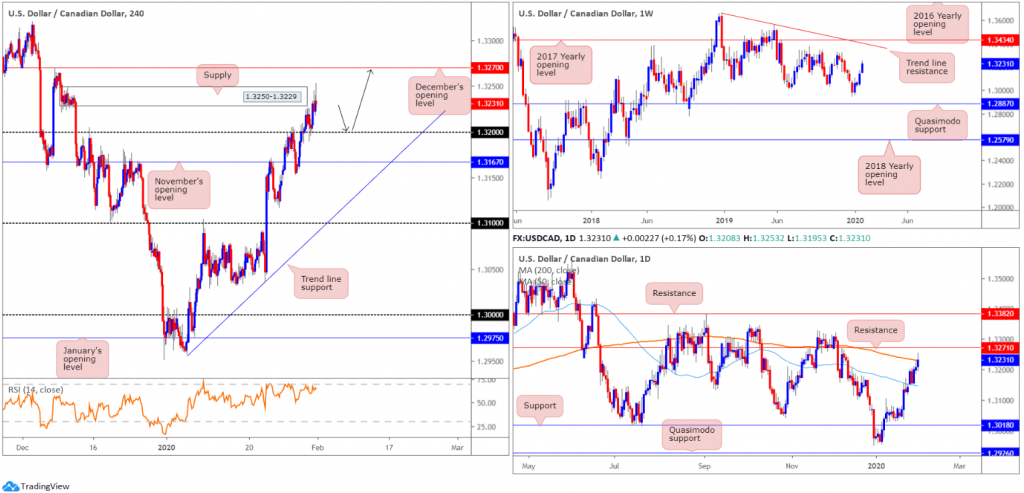

USD/CAD:

Weekly gain/loss: +0.67%

Weekly close: 1.3231

Weekly perspective:

WTI spent the past four weeks in decline from $65.62/bbl, lifting USD/CAD higher, north of Quasimodo support at 1.2887. WTI is also seen closing in on possible support around the $50.51/bbl region, while USD/CAD has eyes on tops around 1.3317, closely followed by trend line resistance (1.3661) and the 2017 yearly opening level at 1.3434.

Daily perspective:

Breaking down the daily timeframe’s recent action, USD/CAD gathered traction north of the 50-day SMA (blue – 1.3146) and went on to challenge the 200-day SMA (orange – 1.3230) at the tail end of the week’s session. This also draws attention to resistance priced in at 1.3271, with a break of this level exposing what appears to be consumed supply to the left of price until reaching resistance at 1.3382.

H4 perspective:

Closing trade on Friday observed H4 activity overpower the upper edge of supply at 1.3250-1.3229, clocking highs at 1.3253. Not only has this move likely tripped buy stops, it has potentially set the stage for a run to December’s opening level at 1.3270, which happens to converge closely with daily resistance highlighted above at 1.3271.

A retest at the 1.32 handle, therefore, may be a consideration for some traders this week, knowing the H4 timeframe’s path north is possibly clear.

On the data front, Friday saw USD/CAD modestly pullback amid better-than-expected Canadian data across the board.

Statistics Canada noted:

Real gross domestic product (GDP) edged up 0.1% in November, offsetting most of the decline in October. Increases in 15 of 20 industrial sectors more than offset notable declines in the mining, quarrying and oil and gas extraction and transportation and warehousing sectors, influenced partly by disruptions in rail transportation service and crude oil pipeline transportation.

Prices for raw materials purchased by manufacturers operating in Canada, as measured by the Raw Materials Price Index (RMPI), rose 2.8%, mainly due to higher prices for crude energy products.

In December, the Industrial Product Price Index (IPPI) was up 0.1%, following a 0.1% decline in November. The IPPI excluding energy and petroleum products also rose 0.1%.

Areas of consideration:

While the break of H4 supply is a potential cue for higher levels, the problem falls on the daily timeframe. The 200-day SMA, currently sited around the 1.3230ish mark, may hamper upside in the event a retest at 1.32 emerges this week. Aside from waiting for additional H4 bullish candlestick confirmation to form off 1.32 (entry and risk levels can be determined according to this pattern), which may attract enough attention to break the 200-day SMA, there’s not much we can really do, other than hope price turns higher in line with H4 and weekly directional flow.

USD/CHF:

Weekly gain/loss: -0.81%

Weekly close: 0.9632

Weekly perspective:

In the mould of a notable outside candlestick pattern, weekly price turned lower from the 2018 yearly opening level at 0.9744, a resistance, and wrapped up the week a few points off lows at 0.9628.

The next downside target sits within 0.9410/0.9516, comprised of a 78.6% Fibonacci retracement at 0.9410, support at 0.9441 and a 127.2% AB=CD bullish correction (black arrows]) at 0.9516 – green.

Daily perspective:

Leaving resistance at 0.9771 unchallenged Wednesday, price closed forming a clear-cut shooting star pattern. Both Thursday and Friday continued to drive lower, settling the week within striking distance of the 0.9613 January 16th low, stationed a few points above Quasimodo support at 0.9600. Beyond here, chart studies display limited support until reaching the top edge of the weekly timeframe’s downside target at 0.9516.

H4 perspective:

The US dollar continued to navigate lower ground vs. the Swiss franc Friday, as traders appeared to favour the safe-haven Swiss franc amid heightened concern surrounding the coronavirus and its impact on the global economy.

For traders who read recent technical reports you may recall the following (italics):

USD/CHF witnessed healthy bidding amid London hours Wednesday, based on broad USD buying. Things turned sour off session highs at 0.9766 in US trading, however, pressured from a strong area of Fibonacci confluence on the H4 timeframe and nearby daily resistance at 0.9771, between 0.9771/0.9750 (green). What also made this area appealing was the buy stops tripped above the 0.9762 January 10th high; this provided liquidity to sell into, and also the relative strength index (RSI) struck its overbought value.

As can be seen on the H4 timeframe, USD/CHF extended its downside presence, brushing aside January’s opening level at 0.9671. The aforementioned 0.9613 January 16th low, closely followed by the 0.96 handle (also represents daily Quasimodo support) is next on tap.

Areas of consideration:

Traders short 0.9771/0.9750, based on the H4 timeframe, likely reduced risk to breakeven and cashed in a portion of the position at the tail end of Wednesday’s session. Well done to those who managed to hold their positions. As underscored above, 0.9613 is the next support target in sight.

With higher-timeframes suggesting further selling, traders may watch for a retest at 0.9671 to form today/early week, with the expectation of a charge towards 0.96ish.

Dow Jones Industrial Average:

Weekly gain/loss: -2.35%

Weekly close: 28287

Weekly perspective:

Heightened fears the Chinese coronavirus epidemic may slow economic growth rattled Wall Street, erasing more than 650 points last week.

Should further downside develop this week, technical research reveals the unit may be headed for another retest at trend line resistance-turned support (26670), and support coming in at 27335.

Daily perspective:

Friday’s 600-point slide jumped through the 50-day SMA (blue – 28483) and dipped a toe in waters around support at 28210. A rejection from this angle could see price attempt to reclaim the aforementioned SMA, while abandoning 28210 has the potential to stretch as far south as weekly support underlined above at 27335.

H4 perspective:

Recent selling forced moves south of January’s opening level at 28595, bottoming a handful of points ahead of December’s opening level at 28074, confirmed by the relative strength index (RSI) chalking up bullish divergence nearby oversold territory (blue line). Note 28074 also boasts supporting confluence (green) in the form of a 161.8% Fibonacci extension at 27968 and a 61.8% Fibonacci retracement at 28115. It may also be of interest to note beneath 28074, chart studies have support in sight at 27713.

In terms of the major indexes, the Dow Jones Industrial Average fell 603.41 points, or 2.09%; the S&P 500 declined 58.14 points, or 1.77% and the tech-heavy Nasdaq 100 ended lower by 144.57 points, or 1.58%.

Areas of consideration:

Although the weekly timeframe indicates lower levels this week, the 27968/28115 H4 reversal zone may bounce price, knowing it converges closely with daily support mentioned above at 28210.

Another interesting point worth noting is the USD/JPY sports a similar reversal zone to watch this week around 108/108.20. Both markets boast a reasonably strong correlation at the moment.

Traders who feel the confluence supporting 27968/28115 is sufficient may opt to enter long at the top edge of the zone and position protective stop-loss orders beneath the lower edge. Conservative traders may choose to wait for H4 price to close higher after entering the zone. This allows an entry on the closing candle, with protective stop-loss orders beneath the lower edge of the base.

In terms of upside targets, January’s opening level at 28595 is the next logical step.

XAU/USD (GOLD):

Weekly gain/loss: +1.16%

Weekly close: 1589.6

Weekly perspective:

Following a clear-cut hammer candlestick configuration (considered a bullish signal at troughs) off support at 1536.9 three weeks ago, continued bidding has been seen since.

Last week added more than $18 and settled a touch south of supply coming in at 1616.8-1592.2. A break through here this week and we are likely headed for resistance at 1636.0.

Daily perspective:

Since connecting with support at 1550.3 mid-January, bulls were initially hesitant. Though considering additional support emerging from the weekly timeframe around 1536.9, upside was eventually observed. Other layers of support worth mentioning are 1518.0 and the 50-day SMA (blue – 1513.7). Candlestick traders may also wish to acknowledge Friday closed in the form of a bullish outside day.

The focus from here likely rests around the 1611.3 January 8th high, though a violation could lead to weekly resistance at 1636.0 making an appearance.

H4 perspective:

A brief recap of Friday’s action on the H4 timeframe reveals the yellow metal benefitted on the back of heightened fears the Chinese coronavirus epidemic may slow economic growth. Risk-off flows elevated bullion to highs at 1590.3, consequently sliding through Quasimodo resistance at 1587.9 into the close.

Breaking 1587.9 will tempt further buying today/early week, though nearby weekly supply at 1616.8-1592.2 could hamper upside. Should we turn lower, the point (yellow) local trend line resistance-turned support, taken from the high 1568.6 and another trend line support, extended from the low 1535.7, merge, is an interesting convergence, likely to hold if tested. Below the said trend line supports, several intraday lows are seen followed by Quasimodo support at 1540.0.

Areas of consideration:

Potential shorts may emerge off H4 Quasimodo resistance at 1587.9, though traders are urged to pencil in the possibility of a fakeout to the underside of the weekly supply (1592.2), before turning lower. It may, therefore, be an idea to consider waiting for additional candlestick confirmation, such as a shooting star pattern or an engulfing formation, before committing (entry and risk levels can be defined according to this structure).

As for support, traders’ crosshairs are likely fixed on the point the two H4 trend lines converge, for an intraday bounce higher. Like the Quasimodo resistance above, it may be a good idea to consider waiting for additional candlestick confirmation, due to trend lines being prone to fakeouts.

The accuracy, completeness and timeliness of the information contained on this site cannot be guaranteed. IC Markets does not warranty, guarantee or make any representations, or assume any liability regarding financial results based on the use of the information in the site.

News, views, opinions, recommendations and other information obtained from sources outside of www.icmarkets.com.au, used in this site are believed to be reliable, but we cannot guarantee their accuracy or completeness. All such information is subject to change at any time without notice. IC Markets assumes no responsibility for the content of any linked site.

The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site. IC Markets is not liable for any harm caused by the transmission, through accessing the services or information on this site, of a computer virus, or other computer code or programming device that might be used to access, delete, damage, disable, disrupt or otherwise impede in any manner, the operation of the site or of any user’s software, hardware, data or property.