A note on lower-timeframe confirming price action…

Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails/wicks – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

- Candlestick patterns. We tend to stick with pin bars and engulfing bars as these have proven to be the most effective.

We typically search for lower-timeframe confirmation between the M15 and H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 3-5 pips beyond confirming structures.

EUR/USD:

During the course of yesterday’s sessions, the H4 candles remained sandwiched between a supply at 1.0828-1.0814 and a support area drawn from 1.0797-1.0780. Seeing as price concluded the day within the walls of this support area, there’s a possibility that the bulls may attempt to lift the pair north today. While this may be true, we believe the bears could have the upper hand here for two reasons:

- The spike seen below the support area likely activated a truckload of sell stops (black arrow), and thus potentially may have weakened bids here.

- Higher-timeframe structure shows that the major recently crossed paths with a weekly resistance barrier coming in at 1.0819 that stretches as far back as mid-2015. Adding to this, the closest higher-timeframe support structure does not come into view until we reach the daily support area formed at 1.0714-1.0683.

Our suggestions: In view of the above points, we believe that a reasonably strong bearish bias is present. Nevertheless, before our desk can become sellers, a H4 close will need to be seen beyond the current H4 support area. This – coupled with a strong retest to the underside of this zone would, in our humble opinion, be enough to justify a sell, targeting the H4 demand at 1.0705-1.0723 (positioned around the top edge of the aforementioned daily support area).

Data points to consider: US jobless claims at 12.30pm, Fed Chair Janet Yellen speaks at 12.45pm, US new home sales at 2pm, FOMC member Kashkari speaks at 4.30pm, FOMC member Kaplan speaks at 11pm GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Watch for price to engulf 1.0797-1.0780 and then look to trade any retest seen thereafter (stop loss: dependent on the rejection candle, as we’d look to place it beyond the rejection candle’s wick).

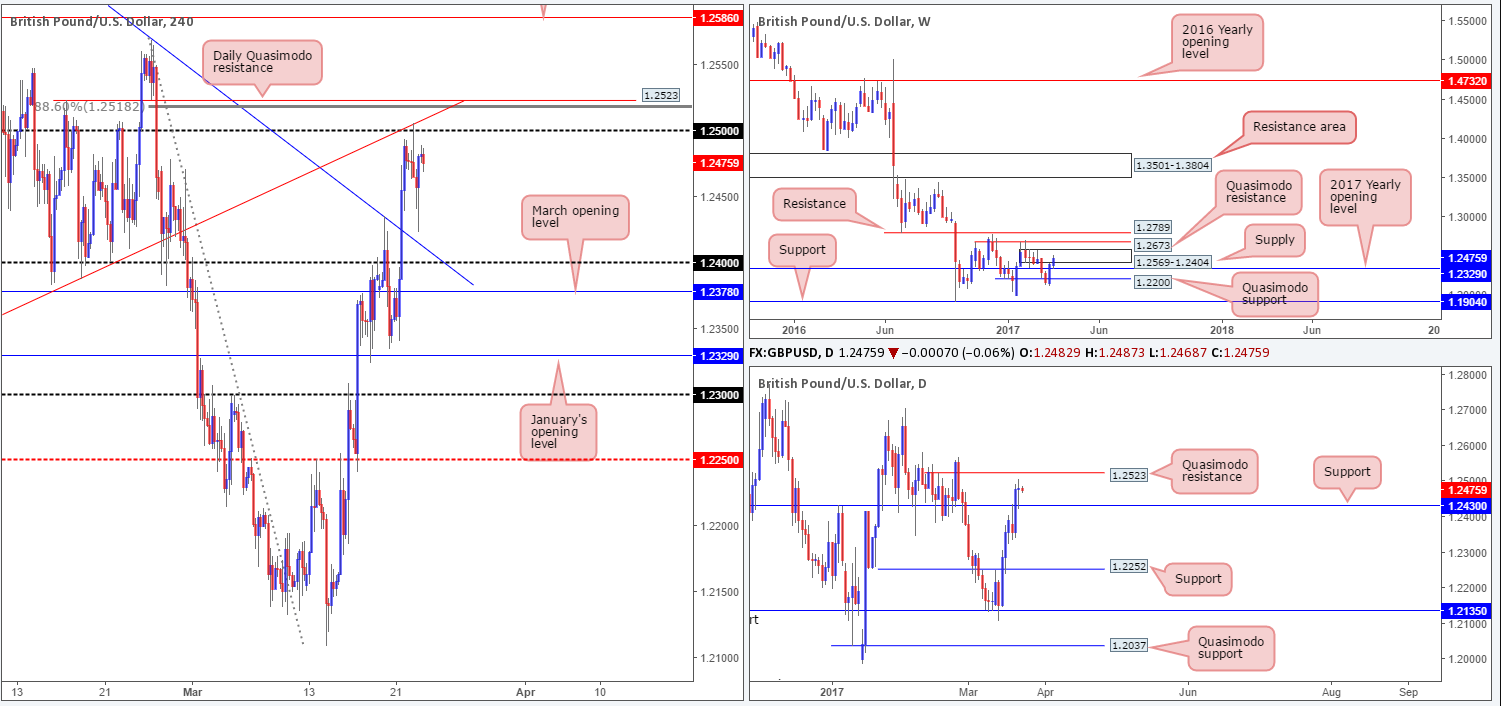

GBP/USD:

For those who read Wednesday’s report you may recall our team highlighting the H4 sell zone seen at 1.2523/1.25. The reasons for selecting this area were as follows:

- The 1.25 handle.

- A H4 trendline resistance taken from the low 1.2346.

- An 88.6% H4 retracement seen at 1.2518.

- A daily Quasimodo resistance level coming in at 1.2523.

- All of the above structures are located within weekly supply positioned at 1.2569-1.2404.

Well done to any of our readers who took advantage of this move yesterday.

Moving forward, we can see that daily support was brought into play yesterday at 1.2430. The rebound from here is considered strong, in our book. As a result, this could force daily price to challenge the daily Quasimodo resistance at 1.2523 sometime today, which as we already know is housed within the aforementioned weekly supply.

Our suggestions: With offers now likely weakened around the 1.25 boundary from yesterday’s move, our focus turns to the daily Quasimodo resistance seen just above it at 1.2523. Merging closely with the H4 trendline resistance taken from the low 1.2346, an 88.6% H4 retracement seen at 1.2518 and not forgetting where this daily line is positioned on the weekly timeframe (see above), we’ll be (dependent on the time of day) looking to short from here with stops placed above the weekly supply at 1.2571.

Data points to consider: MPC member Broadbent speaks at 9.15am, UK retail sales at 9.30am. US jobless claims at 12.30pm, Fed Chair Janet Yellen speaks at 12.45pm, US new home sales at 2pm, FOMC member Kashkari speaks at 4.30pm, FOMC member Kaplan speaks at 11pm GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: 1.2523 region (stop loss: 1.2571).

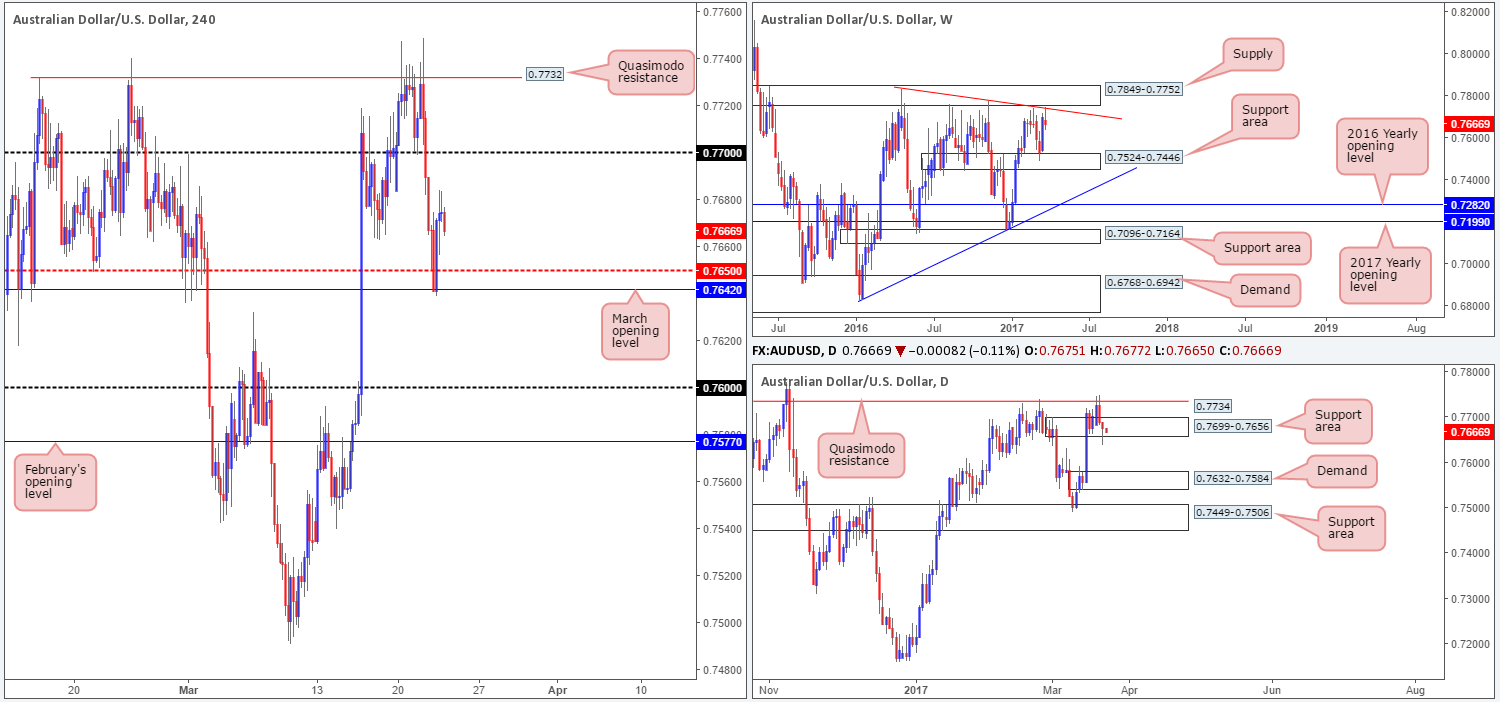

AUD/USD:

Amid yesterday’s trading, the commodity-linked currency pair ran into a strong floor of bids after momentarily surpassing the H4 mid-way support at 0.7650 and tapping March’s opening level at 0.7642. In addition to this, over on the daily chart, price pierced through the lower edge of a support area drawn at 0.7699-0.7656, and ended the day forming a daily buying tail. Having said this though, one also has to take in to account that weekly action is currently selling off from a weekly trendline resistance taken from the high 0.7835.

Our suggestions: Despite the daily buying tail, upside still looks weak, in our view. However, at the same time, selling into a daily support area is just too risky for our liking, no matter what the weekly timeframe suggests!

Before our team can consider shorts, a H4 close is required beyond March’s opening level mentioned above at 0.7642. Not only will this likely clear bids from within the current daily support area, it seems to also open up some space on the H4 chart down to the 0.76 handle. Therefore, a H4 close below 0.7642, followed up with a strong retest to this line as resistance would be ideal grounds to sell this market!

Data points to consider: US jobless claims at 12.30pm, Fed Chair Janet Yellen speaks at 12.45pm, US new home sales at 2pm, FOMC member Kashkari speaks at 4.30pm, FOMC member Kaplan speaks at 11pm GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Watch for price to engulf 0.7642 and then look to trade any retest seen thereafter (stop loss: dependent on the rejection candle, as we’d look to place it beyond the rejection candle’s wick).

USD/JPY:

Beginning with a look at the weekly chart this morning, the buyers and sellers remain battling for position around the weekly support area at 111.44-110.10. Down on the daily chart, nevertheless, we can see that the sellers printed a seventh consecutive bearish candle yesterday, which happened to engulf the daily demand base at 111.35-112.37. Leaving the nearby daily broken Quasimodo line at 110.58 unchallenged, price is now seen retesting the underside of the recently broken daily demand as resistance.

Jumping across to the H4 chart, the 111 handle held firm despite two back-to-back whipsaws. However, we do not consider this a buy signal, for two reasons:

- Daily price could respect the underside of 111.35-112.37 as resistance.

- Daily price may want to dive lower to connect with the aforementioned daily broken Quasimodo line.

Our suggestions: While 111 could remain intact today, we would prefer to wait for price to touch gloves with the daily broken Quasimodo line at 110.58 before looking to go long. That way, traders have the option of placing their stops beyond the weekly support area!

Data points to consider: US jobless claims at 12.30pm, Fed Chair Janet Yellen speaks at 12.45pm, US new home sales at 2pm, FOMC member Kashkari speaks at 4.30pm, FOMC member Kaplan speaks at 11pm GMT.

Levels to watch/live orders:

- Buys: 110.58 region (stop loss: ideally beyond the current weekly support area at 110.08ish).

- Sells: Flat (stop loss: N/A).

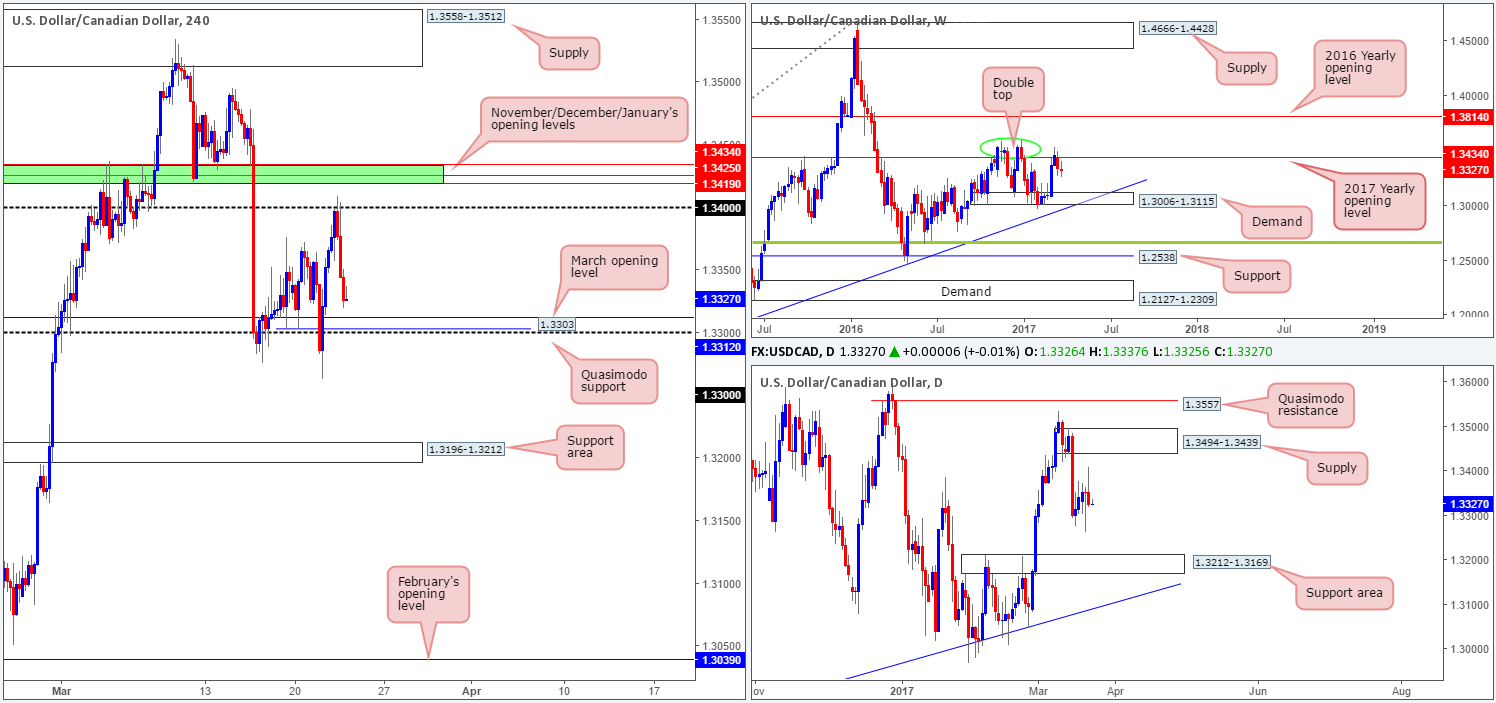

USD/CAD:

With oil prices gaining strength yesterday, the USD/CAD hit the brakes and reversed from the 1.34 handle going into the early hours of the US segment. The day ended with price closing just ahead of March’s opening level at 1.3312. Considering that this monthly level converges with a H4 Quasimodo support at 1.3303 and the 1.33 handle, would we deem this a stable enough zone to trade long from today? Well, weekly action is currently trading below the 2017 yearly opening level at 1.3434, and shows room to drop lower from here. Daily action on the other hand, offers very little in terms of direction given that the unit is seen meandering mid-range between a supply coming in at 1.3494-1.3439 and a support area at 1.3212-1.3169.

Our suggestions: While a bounce is highly likely to be seen from the H4 1.33/1.3312 neighborhood, we would strongly advise waiting for a lower-timeframe confirming signal to take shape before pressing the buy button (see the top of this report), due to the lack of higher-timeframe confluence.

Data points to consider: US jobless claims at 12.30pm, Fed Chair Janet Yellen speaks at 12.45pm, US new home sales at 2pm, FOMC member Kashkari speaks at 4.30pm, FOMC member Kaplan speaks at 11pm GMT.

Levels to watch/live orders:

- Buys: 1.33/1.3312 ([waiting for a lower-timeframe buy signal to form is advised before pulling the trigger] stop loss: dependent on where one confirms this area).

- Sells: Flat (stop loss: N/A).

USD/CHF:

In recent sessions, the Swissy punched its way through the H4 demand at 0.9903-0.9921 and the 0.99 handle, leaving price free to tag February’s opening level at 0.9890 as the US opened their doors for business. With the help of the daily support area seen at 0.9842-0.9884, bids held firm from 0.9890 and rallied strongly into the closing bell. Although H4 upside looks relatively clear up to the broken Quasimodo line at 0.9951, which happens to merge nicely with a daily resistance level at 0.9950 and a nearby daily supply at 1.0001-0.9957, we’re a tad concerned by the recent break of the weekly trendline support etched from the low 0.9443.

Our suggestions: Without knowing whether or not the break of the weekly trendline is genuine or just a deep fakeout, this market is a tricky beast to trade at the moment.

In addition to the above, even if one were to take a long in this market, there’s little wiggle room seen for price to move before we connect with the 0.9950 region! Therefore, in the absence of clearer price action, we’ll remain flat for the time being and reassess structure going into tomorrow’s open.

Data points to consider: US jobless claims at 12.30pm, Fed Chair Janet Yellen speaks at 12.45pm, US new home sales at 2pm, FOMC member Kashkari speaks at 4.30pm, FOMC member Kaplan speaks at 11pm. CHF Gov. board member Maechler speaks at 5pm GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).

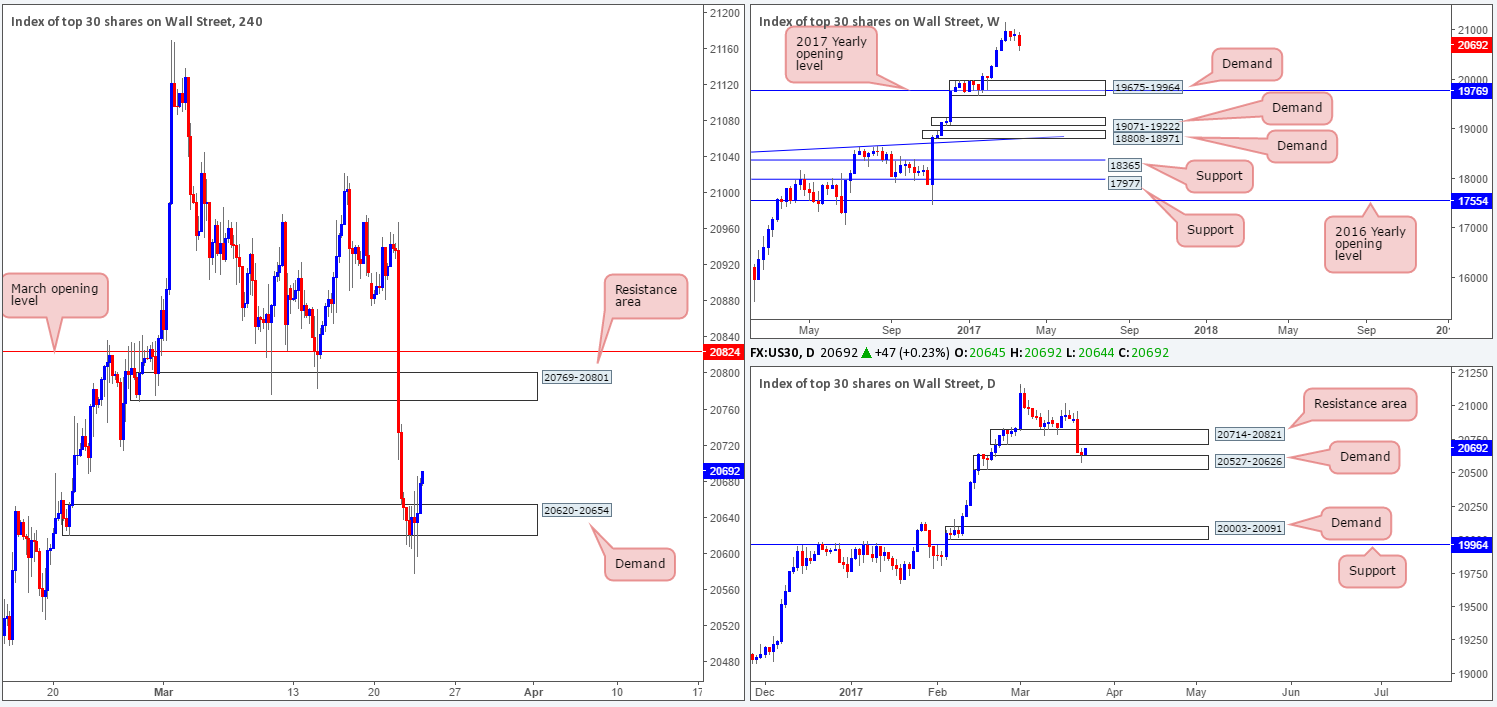

DOW 30:

Following the DOW’s rather impressive downside move on Tuesday, the index managed to hold ground, albeit after multiple whipsaws, around the H4 demand base drawn from 20620-20654. To our way of seeing things, the next upside target is located close by around the underside of the daily resistance area at 20714, followed closely by the H4 resistance area at 20769-20801. Therefore, entering long at current prices is not something that interests us. Selling, however, is also not something we’d be comfortable taking part in due to the current support structure in play, and the fact that the US equity market is still in a strong position according to the weekly chart!

Our suggestions: Quite simply, we would recommend placing this market on the backburner today and revisiting it at tomorrow’s open. Hopefully, we’ll see some development by then.

Data points to consider: US jobless claims at 12.30pm, Fed Chair Janet Yellen speaks at 12.45pm, US new home sales at 2pm, FOMC member Kashkari speaks at 4.30pm, FOMC member Kaplan speaks at 11pm GMT.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).

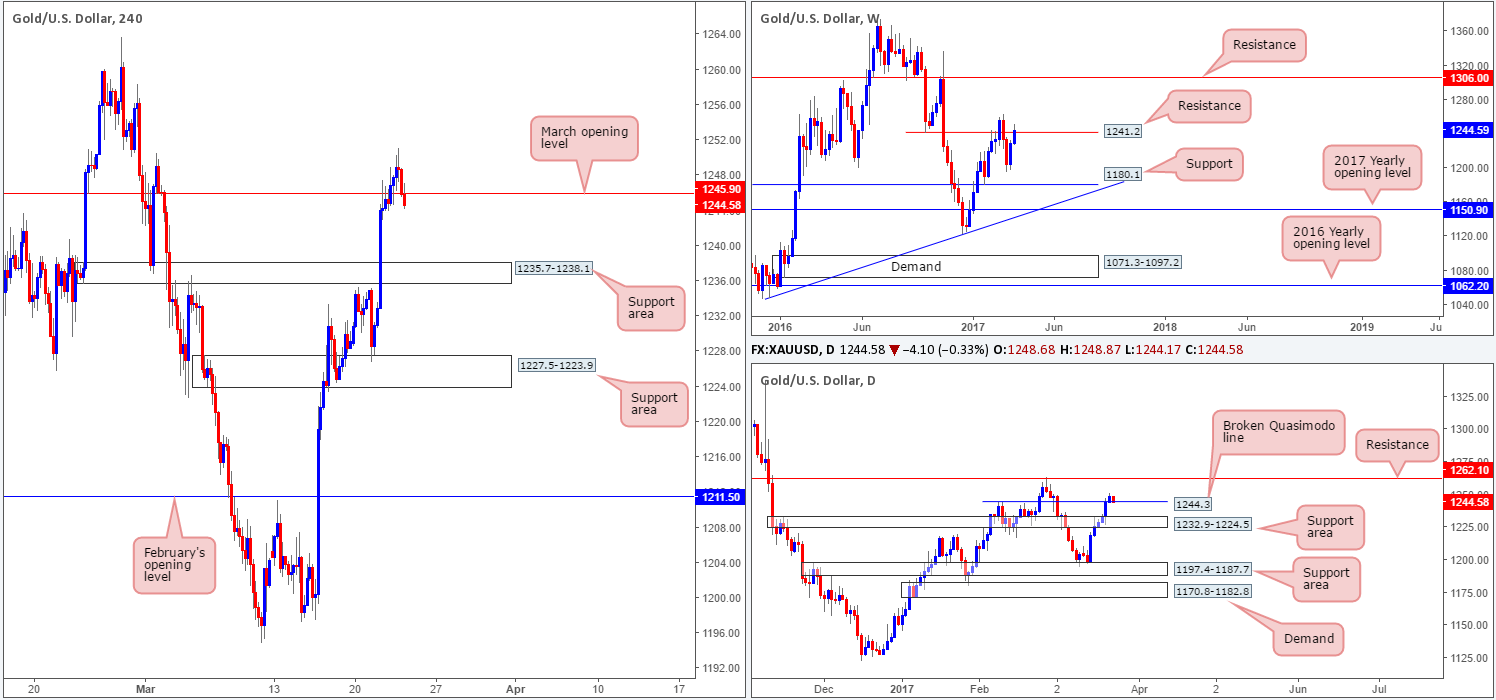

GOLD:

Kicking this morning’s report off with a quick peek at the weekly chart, we can see that the buyers and sellers continue to battle for position around the resistance line pegged at 1241.2. The story on the daily chart, nonetheless, shows that price recently engulfed the Quasimodo resistance level at 1244.3, and is, at the time of writing, now seen retesting it as support. In the event that this boundary holds ground, the next area of interest can be seen around a daily resistance line at 1262.1.

Moving across to the H4 chart, structure shows that price briefly broke above the March 1st high at 1250.5 yesterday, and retreated into the close. With the H4 candles now seen trading back below March’s opening level at 1245.9, there is space seen for this unit to test the support area at 1235.7-1238.1.

Our suggestions: However, taking a trade short on the basis of the break below March’s opening level is not something we’d label high probability. Weekly action remains undecided around the 1241.2 neighborhood, and daily price is, as we mentioned above, seen testing 1244.3 as support. With that, our team’s position will remain flat going into today’s segment.

Levels to watch/live orders:

- Buys: Flat (stop loss: N/A).

- Sells: Flat (stop loss: N/A).