EURUSD:

EUR/USD rallied overnight after it broke above 1.05 resistance in the early Asian session and reached a high of 1.0653. However, this happened at a time when liquidity is the lowest, especially now ahead of New Year's Eve. The rally was quickly retraced and EUR/USD is now back at 1.0530.

Overall, the outlook remains negative, but we might see further EUR strength should USD longs continue to cover their positions into year-end. The key area to watch to the topside is 1.0655/70, while to the downside, support is now seen at 1.05 and 1.0450.

GBPUSD:

GBP/USD failed to benefit much the USD position covering. While it did rally in Asia, it only reached a high of 1.2308, close to where it started this trading week. Resistance proved to be tough there, and the pair fell back to 1.2280.

Price action suggests that further losses are ahead and we are likely to see another test of 1.22 soon. As we noted before, sub-1.22, there is not much support until 1.2115.

USDJPY:

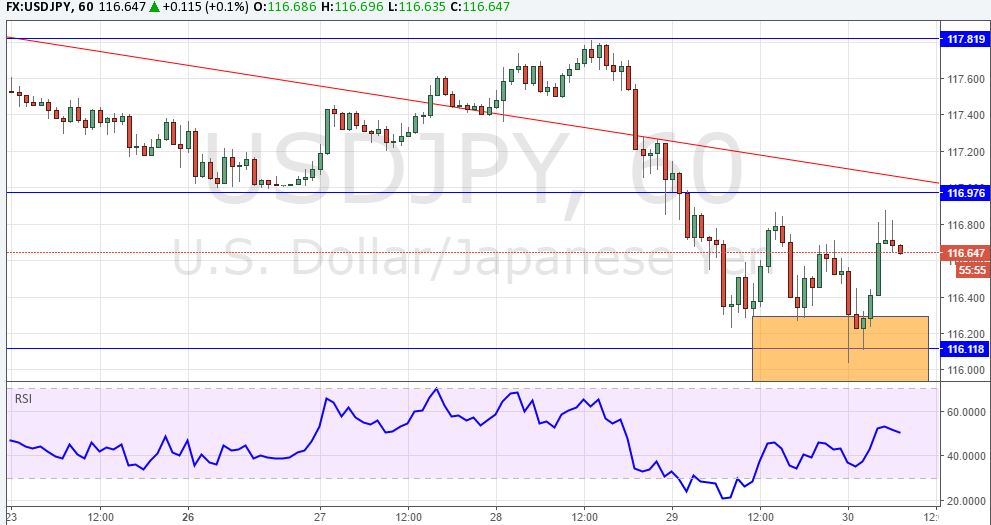

In USD/JPY, we mentioned the 116.10/15 area several times this week, and overnight, it finally reached it. The level was respected and USD/JPY rallied to a high of 116.90 later in the session.

USD/JPY now faces resistance at 117, but given the strong bounce off 116.10, further gains seem likely, with 118 the next major obstacle.

AUDUSD:

AUD/USD rose from 0.7215 to 0.7246 in Asia. Overall, the outlook remains bearish and traders looking to establish short positions, should keep an eye on 0.7280 resistance for an opportunity.

To the downside, 0.7150/60 is now key support, but below that area, there is not much support until 0.70.

NZDUSD:

NZD/USD reached 0.6978 in Asia, but there is a lack of momentum. 0.7040/50 is an attractive resistance area to consider a short position, although it may require more time to reach it.

USDCAD:

USD/CAD is under pressure amid the rally in Oil prices. It almost touched 1.36 on Wednesday, but is now trading around 1.3480. Decent support is seen at 1.3450, but a break below would signal a deeper retracement, to at least 1.3360.

However, the overall outlook remains bullish and buying dips the preferred strategy.

XAUUSD:

In Gold, $1150 was not difficult to breach on the second test, and it extended gains to $1163 in Asia. Watch the $1165 level as we could see a reaction there. Stronger resistance is then seen at $1180, followed by $1200/05.

From the levels mentioned, $1200/05 is the most attractive area to consider a short position, given that it was a significant support area prior to the breakout, and the fact that we have not seen a retest yet.