EURUSD:

EUR/USD extended gains overnight and is slowly marching towards the 1.05 level. Resistance proved to be too strong there on the last test on Thursday, but it is worth to keep an eye on price action around the level, should we see another test of it.

A break above would signal a short squeeze that could extend at least up to 1.06. The next major resistance level would then lie at 1.0670, which is the double top from the mid-December highs.

GBPUSD:

Similar price action can be observed in GBP/USD, which is currently testing 1.23 resistance.

A break above would pave the way for a move towards 1.24, although resistance around 1.2390/1.24 will likely be strong.

USDJPY:

USD/JPY broke above the trendline resistance from the mid-December high, but momentum has decreased noticeably. The long-term time frame charts still show heavily overbought conditions, and while the overall outlook remains bullish, it is likely that a deeper retracement will be required before the pair can continue its way towards 120.

Immediate support can be expected at 116.50/60, although the more interesting area to watch for buy opportunities is 116.10/20, which previously acted as significant resistance area. To the topside, there is decent resistance ahead of the 118 level, with 118.60 still the main obstacle.

AUDUSD:

In AUD/USD, we already highlighted the bullish RSI divergence on the H4 chart yesterday, and the pair has finally caught some momentum to the upside. Following the bounce off 0.7160, it rallied to 0.7212 in Asia and continues to post fresh highs as we are heading into the European Open.

0.7280 is the next key obstacle for AUD/USD, but a break above would then confirm the short-term bottom at 0.7160 and pave the way for a move to at least 0.7370. Traders looking for short opportunities might want to keep an eye on the area around 0.7370, as it acted as key support/resistance several times before.

NZDUSD:

NZD/USD followed the Australian Dollar higher, and rose to a high of 0.6927 in Asia. Immediate resistance is seen at 0.6945/50, although it does not seem like a major obstacle, and NZD/USD should be able to clear it without much difficulties.

The interesting area to watch is 0.7040/50, which would be attractive for establishing a short position. It is still a bit far away from the current price level, but should we see a break above 0.6945, it is likely that the area will get tested in the near-term.

USDCAD:

The momentum in USD/CAD remains strong, and a break above 1.36 seems just a matter of time.

Once that resistance level is broken, there are not any major obstacles until 1.3860. To the downside, support is seen at 1.3515, followed by 1.3470.

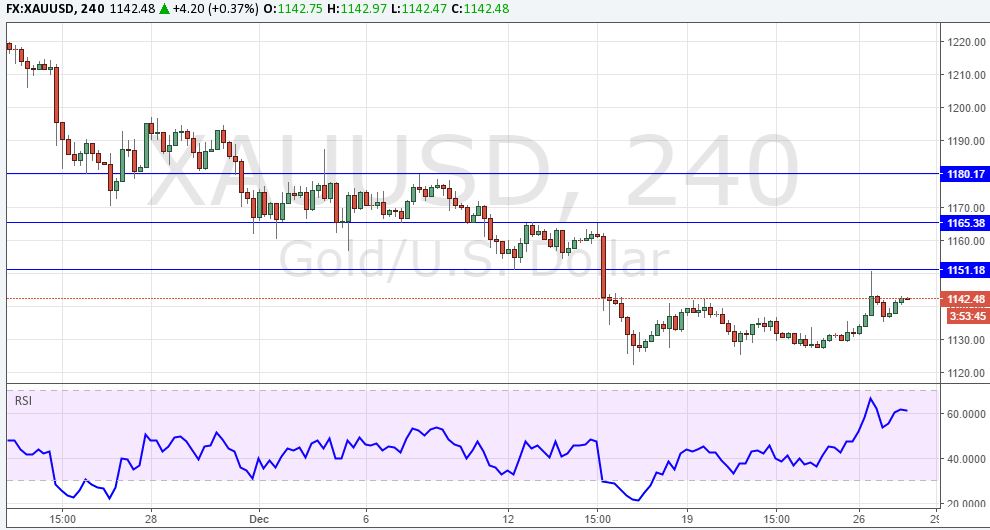

XAUUSD:

Gold saw a sharp rejection off $1150, which we highlighted as key resistance level in our last two reports. A decline back to $1136 followed, although the commodity has managed to recover in Asia.

The overall outlook remains bearish and selling rallies the preferred strategy. $1150 is unlikely to act again as such strong resistance, but should we see a breakout, Gold already faces decent resistance at $1165 and $1180.