A note on lower timeframe confirming price action…

Waiting for lower timeframe confirmation is our main tool to confirm strength within higher timeframe zones, and has really been the key to our trading success. It takes a little time to understand the subtle nuances, however, as each trade is never the same, but once you master the rhythm so to speak, you will be saved from countless unnecessary losing trades. The following is a list of what we look for:

- A break/retest of supply or demand dependent on which way you’re trading.

- A trendline break/retest.

- Buying/selling tails/wicks – essentially we look for a cluster of very obvious spikes off of lower timeframe support and resistance levels within the higher timeframe zone.

- Candlestick patterns. We tend to only stick with pin bars and engulfing bars as these have proven to be the most effective.

We search for lower timeframe confirmation between the M15 the H1 timeframes, since most of our higher-timeframe areas begin with the H4. Stops are usually placed 5-10 pips beyond confirming structures.

EUR/USD:

Shortly after the market opened, the shared currency ran into a strong floor of bids around H4 support drawn from 1.1233, consequently forcing the pair to retest the 1.13 handle going into the close. Well done to any of our readers who managed to pin down a position from this line as it was, alongside the H4 support seen below at 1.1219, a noted move to watch out for in our previous report.

Given that daily action just rebounded from demand at 1.1242-1.1202, there is a chance that the 1.13 line could be taken out today. Assuming this comes to fruition a long position will then be considered on any retest seen thereafter, targeting H4 resistance at 1.1367 (sits two pips below daily supply at 1.1446-1.1369). The only grumble we have regarding this potential trade setup is that weekly price remains trading from supply seen at 1.1533-1.1278. And knowing that this area has capped upside since May 2015 (see red arrows), we feel that the currency will eventually drive lower to touch base with support penciled in at 1.0796 in the near future. Therefore, we would strongly advise our readers to only trade above 1.13 with lower timeframe confirmation. This, as we’ve mentioned in past reports, could be in the form of an engulf of supply followed by a retest, a trendline break/retest or simply a collection of buying tails around support. Stops are usually placed 5-10 pips beyond confirming structures thus allowing the trade room to breathe.

Levels to watch/live orders:

- Buys: Watch for price to consume 1.13 and look to trade any retest seen thereafter (lower timeframe confirmation required).

- Sells: Flat (Stop loss: N/A).

GBP/USD:

This morning’s analysis will begin with a look at the weekly chart, which shows that the buyers and sellers remain battling for position within demand coming in at 1.4005-1.4219 (blends nicely with a broken Quasimodo line at 1.4501). On the assumption that the buyers are victorious here, it’s possible that we may see cable rally back up to 1.4633 – a broken Quasimodo line.

Moving down to the daily chart, sterling is currently seen capped between demand at 1.4090-1.4195 and supply penciled in at 1.4297-1.4393. Any sustained move above this supply would likely place the weekly broken Quasimodo line at 1.4633 back in view, whilst a push below the aforementioned demand immediately opens the door to fresh bids likely waiting at the Quasimodo support taken from 1.4052.

With tensions rising in GBP-related markets regarding the ‘Brexit’ situation, volatility is likely to increase in the coming days. Over on the H4 chart, we can see that price put in a low at 1.4115 during yesterday’s London morning session that followed-through with a 200-pip surge north to connect with H4 resistance at 1.4314. At the time of writing, however, psychological support 1.42 is back in play, and could prove to be a difficult barrier to breach due to where price is positioned on the higher timeframe picture (see above).

Our suggestions: The 1.42 handle could be a line to consider trading from today, targeting the 1.43 hurdle. Trading with caution around this number is something we’d strongly recommend. Waiting for lower timeframe confirmation to form is a MUST for our team to commit capital to this idea (for confirming techniques, see the top of this report).

Levels to watch/live orders:

- Buys: 1.42 region [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

- Sells: Flat (Stop loss: N/A).

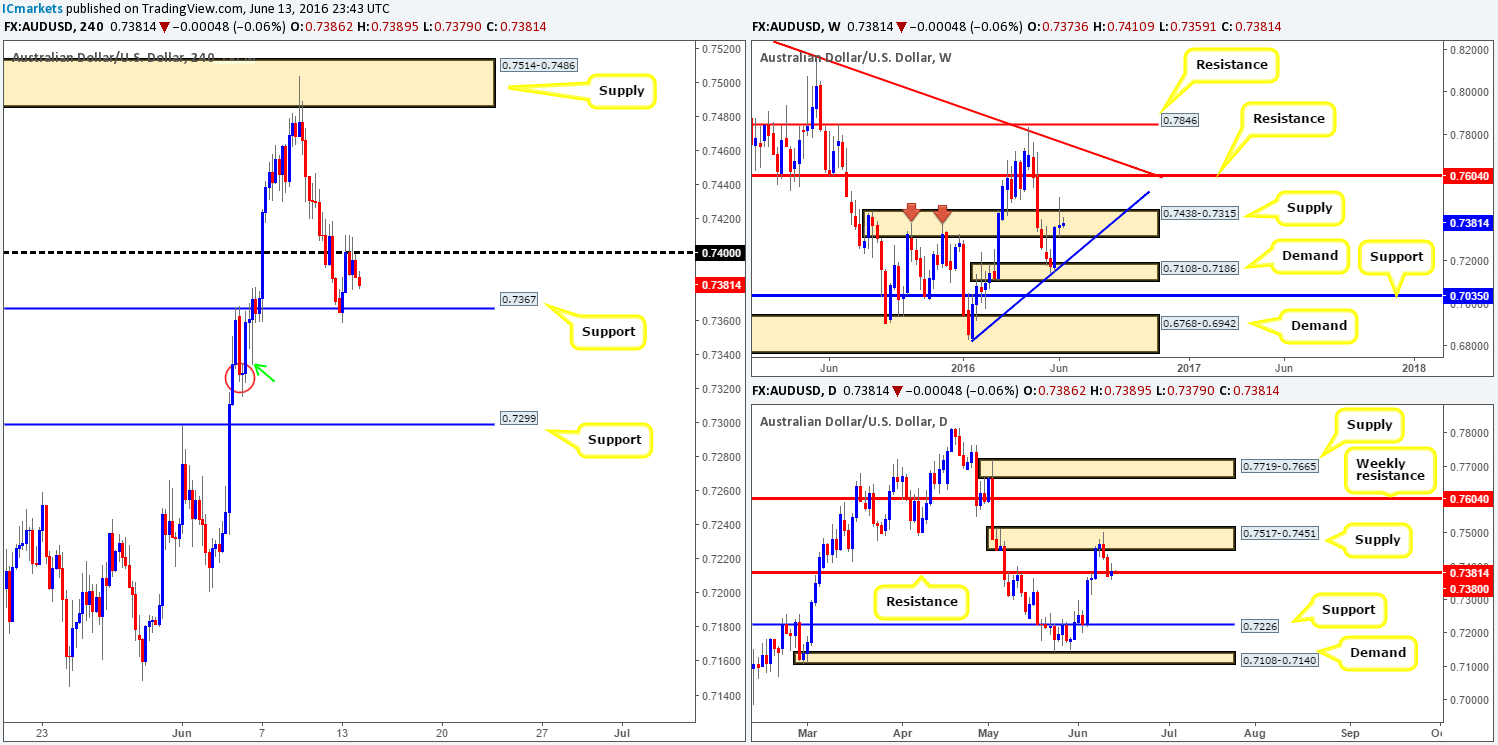

AUD/USD:

Following Friday’s sell-off, the Aussie dollar staged a modest recovery from H4 support at 0.7367 shortly after Sunday’s open. Unfortunately, the rally turned out to be a short-lived one as price failed to sustain gains above the 0.74 handle. Ultimately, our view remains unchanged in this market. To our way of seeing things, the H4 support mentioned above at 0.7367 is on shaky ground, and could possibly be engulfed sometime today. To support this, we have the following:

- Although the most recently closed daily candle closed positively, its wick is evidently larger than the tail. Furthermore, considering that the candle is trading around a daily resistance line at 0.7380, we feel the bears may have the upper hand here. In the event that this barrier is well-offered, the path south appears clear for a push lower down to at least daily support painted at 0.7226.

- Recent action on the weekly chart formed a voluminous selling wick within weekly supply seen at 0.7438-0.7315. With selling interest clearly present within this zone, there is a possibility that we may see the Aussie drive lower this week to touch base with trendline support extended from the low 0.6827.

Our suggestions: Watch for price to break below and retest 0.7367. This would, assuming we managed to pin down a lower timeframe sell setup following the retest (see the top of this report for confirming techniques), be enough for us to enter short this market, targeting H4 support coming in at 0.7299.

The H4 tail seen marked with a green arrow at 0.7334 has likely consumed the majority of bids from H4 demand (red circle) at 0.7324-0.7368, hence our target being set below at 0.7299.

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: Watch for price to consume 0.7367 and look to trade any retest seen thereafter (lower timeframe confirmation required).

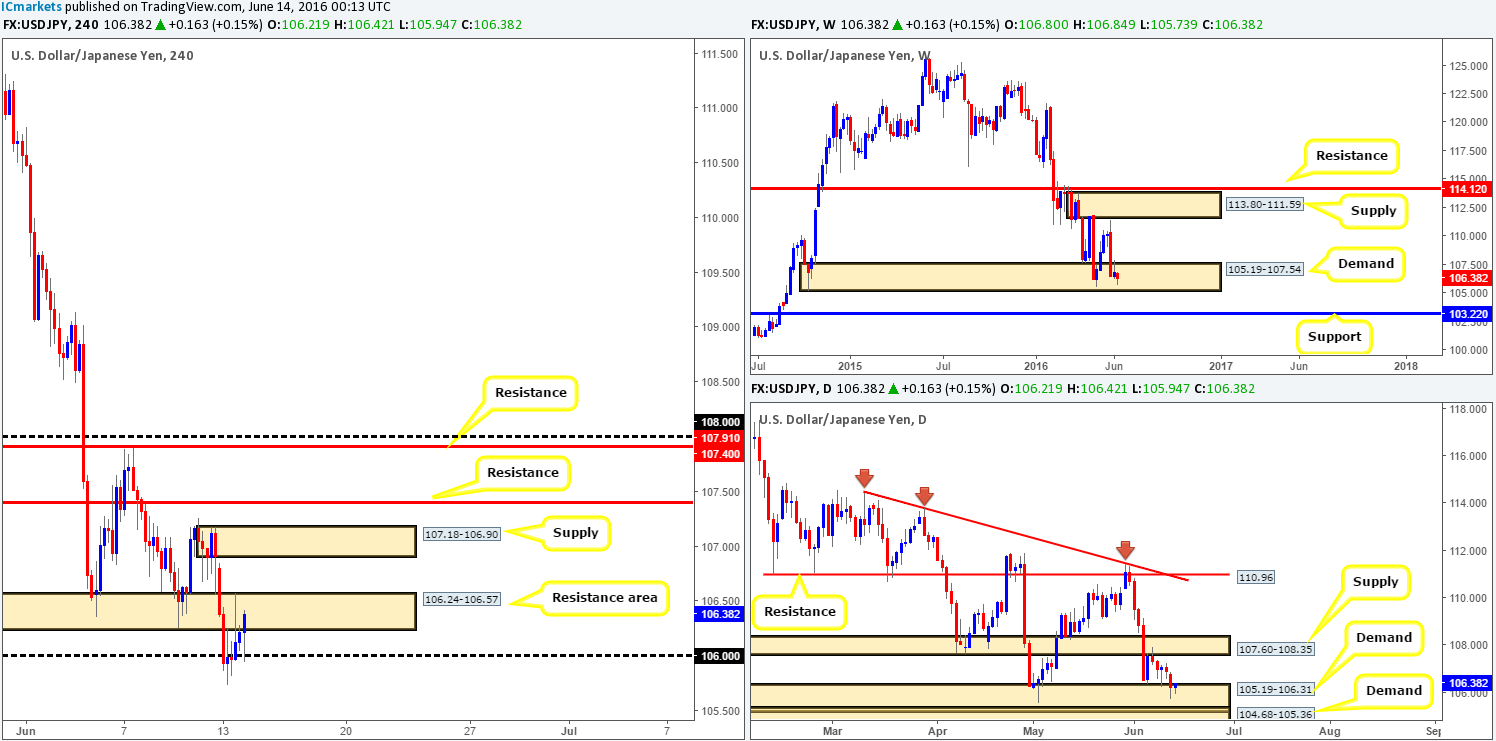

USD/JPY:

The USD/JPY, as you can see, stamped in a low at 105.73 (if you look across to the left, you’ll actually see that the low was printed within an extreme point of H4 demand at 105.49-105.99) on the H4 chart in the early hours of European trade yesterday. From thereon, price engulfed the 106 handle and drove high into a H4 resistance area at 106.24-106.57, which for now is holding firm.

Moving over to the weekly chart, the bulls appear to be struggling to find a foothold within weekly demand at 105.19-107.54. A break below this zone would likely place weekly support at 103.22 on the hit list. Looking down to the daily chart, however, price remains trading within demand at 105.19-106.31, which is located within the extremes of the above said weekly demand base. What we can see from this angle is that there is a supporting daily demand sitting at 104.68-105.36 that could bolster this market should the current daily demand fail.

Our suggestions: Technically, the bulls are likely to make an appearance sometime soon. Buying this market, nevertheless, is tricky for a number of reasons, but mostly because of the current H4 resistance area, followed closely by H4 supply seen at 107.18-106.90, and then a neighboring H4 resistance seen just above at 107.40. This is, at least in our opinion, not an ideal buying scenario no matter where higher timeframe price is positioned! Therefore, opting to stand on the sidelines here may very well be the best path to take today.

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: Flat (Stop loss: N/A).

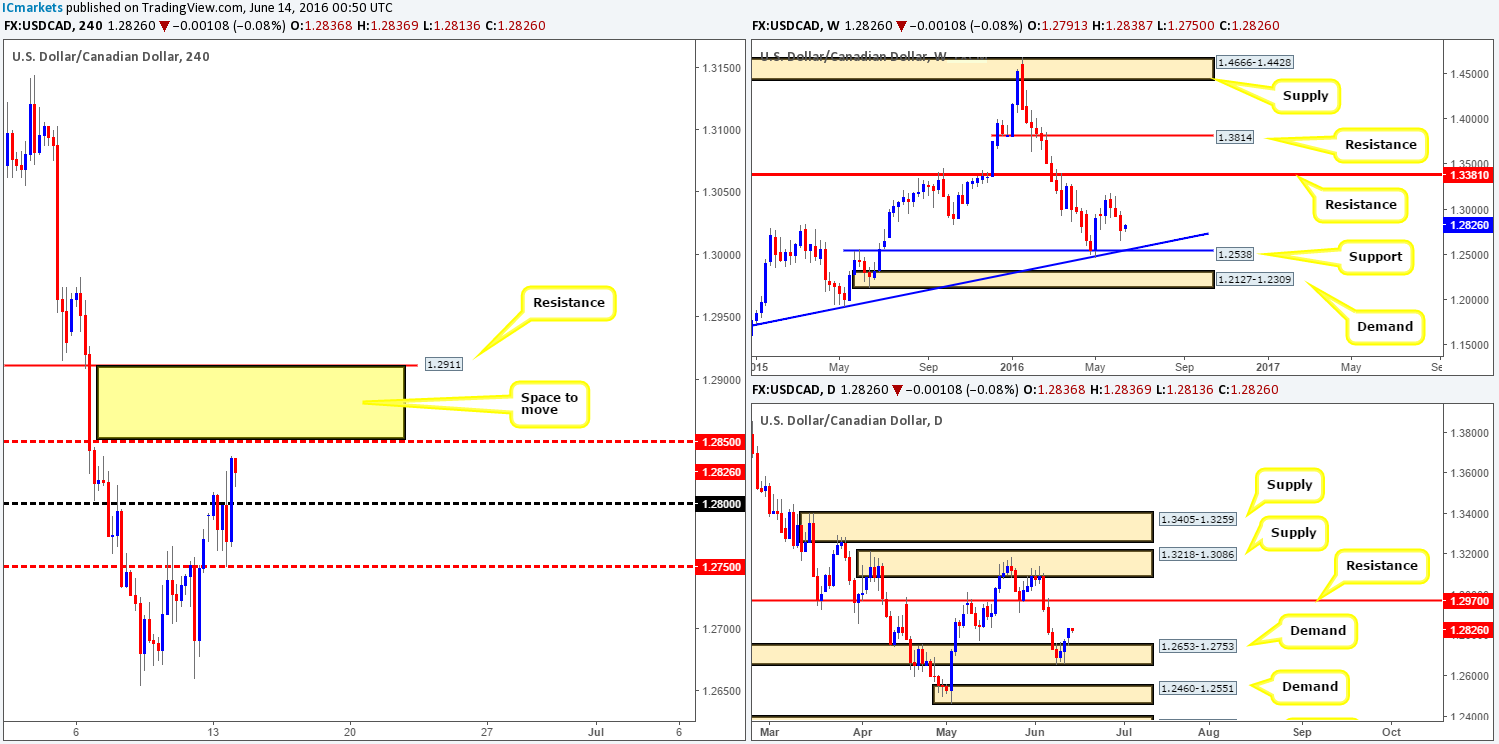

USD/CAD:

During the course of yesterday’s sessions, the loonie retested the H4 mid-way support at 1.2750 beautifully before rallying to highs of 1.2838 on the day. As we mentioned in our previous report, the only neighborhood we’d consider trading at the moment is between 1.2850/1.2911, since there is a clear void (little resistance) seen here for price to move freely. Now, given that daily price extended its bounce from daily demand at 1.2653-1.2753 yesterday, and shows room to continue north up to at least daily resistance at 1.2970, a break above 1.2850 could be on the horizon today.

Our suggestions: Watch for price to engulf 1.2850 and look to trade any retest seen thereafter, targeting 1.2911 – a H4 resistance level. Personally, we will not be taking any long trades above 1.2850 without lower timeframe confirmation as we have been faked out more times than we can remember, only to then see price go on to hit our take-profit target! For ideas on how to spot lower timeframe confirmation and possibly avoid a fakeout, please see the top of this report.

Levels to watch/live orders:

- Buys: Watch for price to consume 1.2850 and look to trade any retest seen thereafter (lower timeframe confirmation required).

- Sells: Flat (Stop loss: N/A).

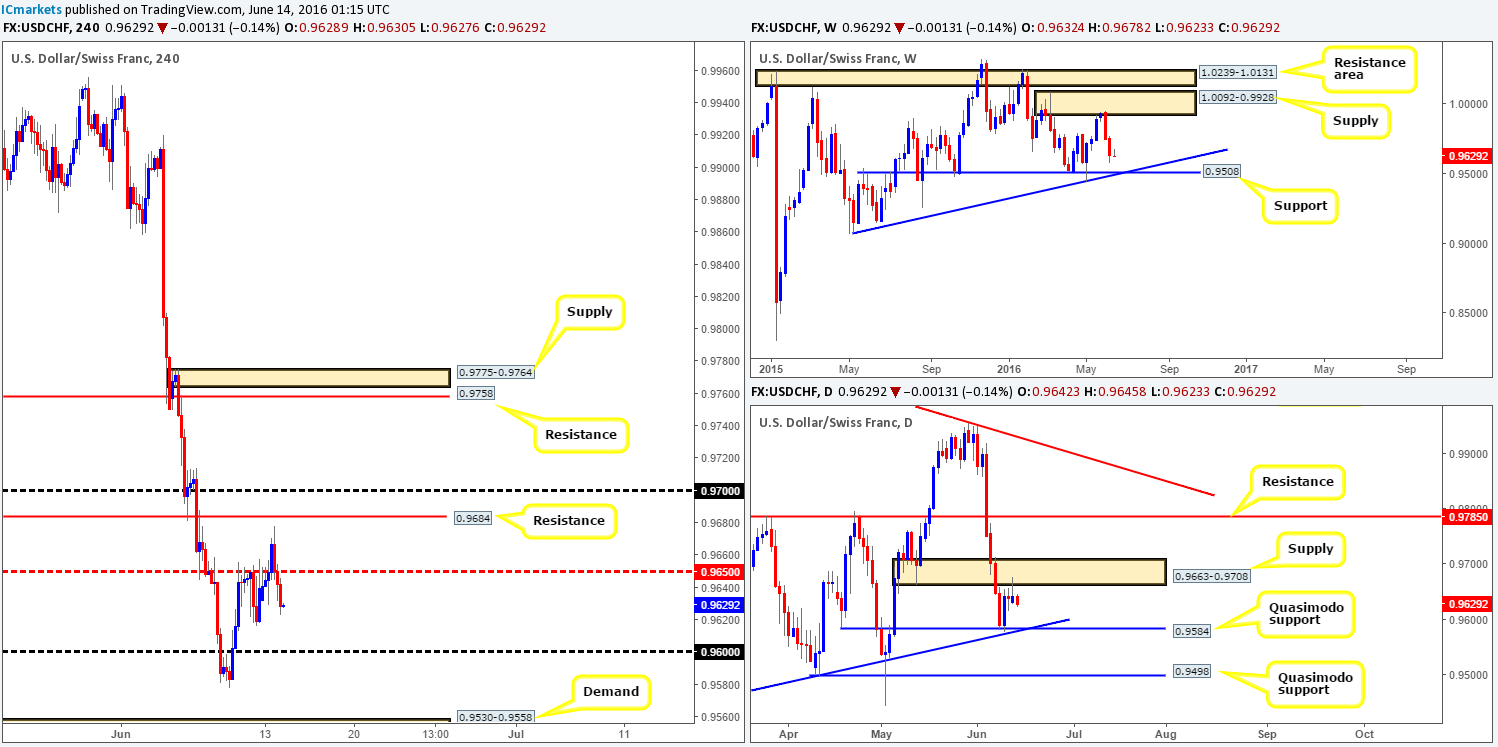

USD/CHF:

Reporting directly from the weekly chart this morning, we can see that the sellers continue to dominate this market. By and large, very little support is seen to stop the Swissy from continuing to push lower this week down to a support drawn from 0.9508, which coincides nicely with trendline confluence taken from the low 0.9078. Turning our attention to the daily chart, price formed a nice-looking selling tail amid yesterday’s session off the back of a daily supply fixed at 0.9663-0.9708. Assuming that this encourages sellers to participate, the next downside target to keep an eye on is the daily Quasimodo support at 0.9584 (trendline confluence taken from the low 0.9078). Moving down one more level to the H4 chart, an aggressive whipsaw through the H4 mid-way resistance at 0.9650 was seen going into London trading yesterday, which was a noted move to watch out for in our previous report!

Our suggestions: Look for lower timeframe sell trades on any retest seen at the 0.9650 line today, targeting the 0.96 handle as your immediate take-profit area. Beyond this zone, we’d be looking down to H4 demand at 0.9530-0.9558, followed closely by the daily Quasimodo support seen at 0.9498 as a final take-profit line.

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: 0.9650 region [Tentative – confirmation required] (Stop loss: dependent on where one confirms this area).

DOW 30:

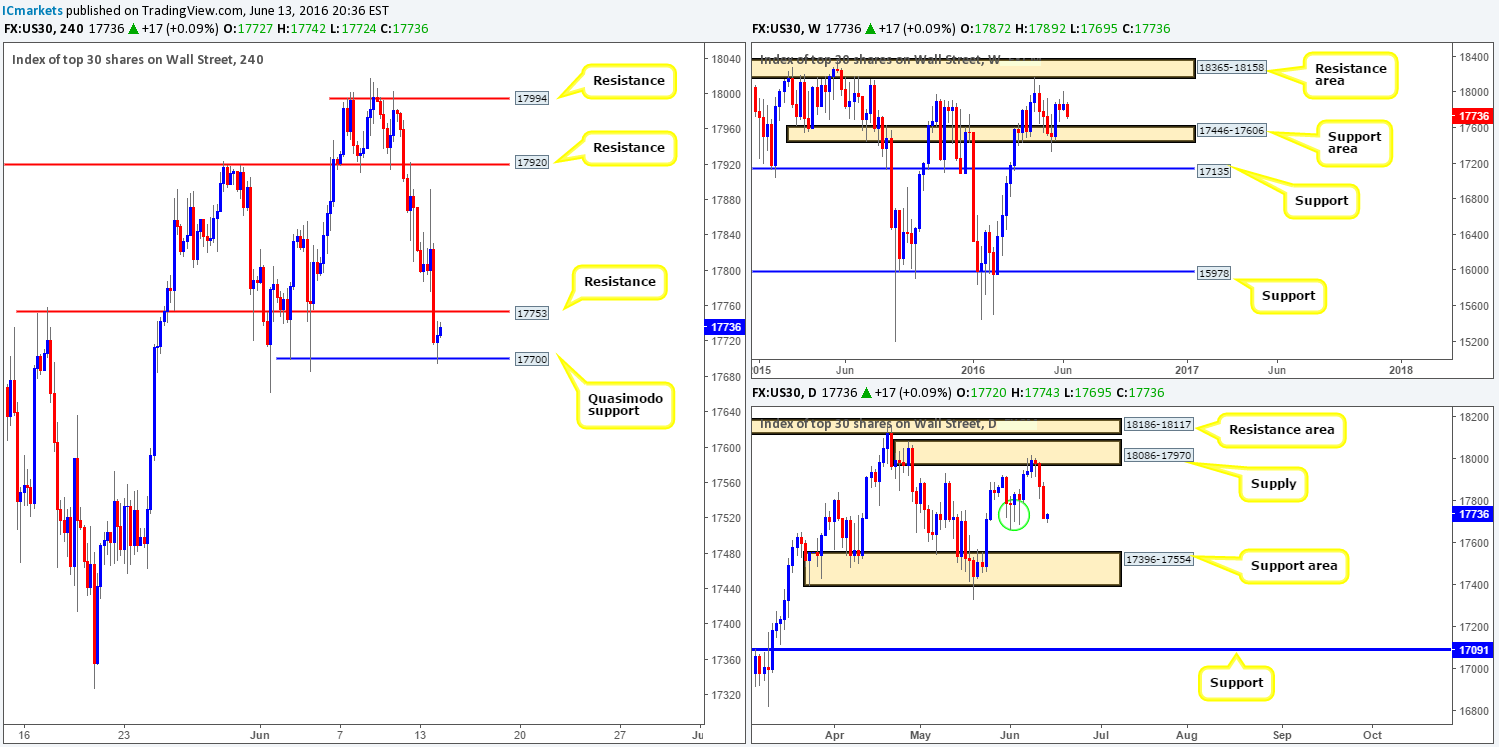

U.S. stocks took another hit to the mid-section yesterday as prices struck fresh lows of 17716 on the day. Sentiment is clearly in negative territory now, as the DOW recently broke through H4 support at 17753 (now acting resistance) in one fell swoop! Be that as it may, the buyers appear to be attempting to stage a comeback from the H4 Quasimodo support line at 17700, which, if you look across to the daily chart, is sitting within a collection of buying tails seen marked with a green circle. However, we feel, due to the weekly chart showing that the path south is clear down to a weekly support area at 17446-17606, price will likely struggle to get above 17753 today.

Our suggestions: Given that weekly price is free to drop further (see above), we are looking for this index to break below the current H4 Quasimodo support line today, and with a little bit of luck, retest the underside as resistance. This would, alongside lower timeframe confirmation (see the top of this report for confirming techniques), be a perfect platform in which to short from, targeting 17606/17554 (17606 represents the top-side of weekly demand, whilst 17554 marks the upper edge of daily demand).

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: Watch for price to consume 17753 and look to trade any retest seen thereafter (lower timeframe confirmation required).

GOLD:

(Trade update: Stopped out at 1283.0)

The yellow metal remained well-bid throughout yesterday’s trading as investors flocked to the safe-haven market. Consequent to this recent surge in buying, H4 supply at 1282.1-1278.5 was recently taken out, and is at the time of writing, being retested as demand.

Fundamentally, gold could rally much higher due to the risk-off environment currently in play. However, from a technical standpoint, bullion is now seen crossing swords with weekly supply penciled in at 1307.4-1280.0, and daily action is trading within the extremes of a daily supply zone coming in at 1288.5-1272.9.

Our suggestions: We would be very careful buying from the current H4 demand given where the shiny metal is positioned on the higher timeframe picture (see above). The only thing that really tickles our fancy right now is if we see price break below the current H4 demand followed by a retest as supply. This – coupled with lower timeframe confirming price action would be enough for our team to consider a short, targeting H4 demand at 1264.4-1266.5 (sits just above daily support at 1262.2). For ideas on how to spot lower timeframe confirmation, please see the top of this report.

Levels to watch/live orders:

- Buys: Flat (Stop loss: N/A).

- Sells: Watch for price to consume 1282.1-1278.5 and look to trade any retest seen thereafter (lower timeframe confirmation required).